During my previous role at a credit rating agency, lenders and investors often asked me questions over the rapidly rising debt of NHAI (rated AAA) and consequent impact on its credit profile. To which, my response was not to view NHAI as a commercial entity but as an extended arm of MoRTH (Central Govt Ministry), carrying the responsibility of developing road infrastructure in the country. Though the dichotomy to this argument is the fact that NHAI’s debt is not getting consolidated with Government’s overall borrowings. The recent budget proposals related to controlling NHAI’s debt would have certainly allayed the concerns of investors.

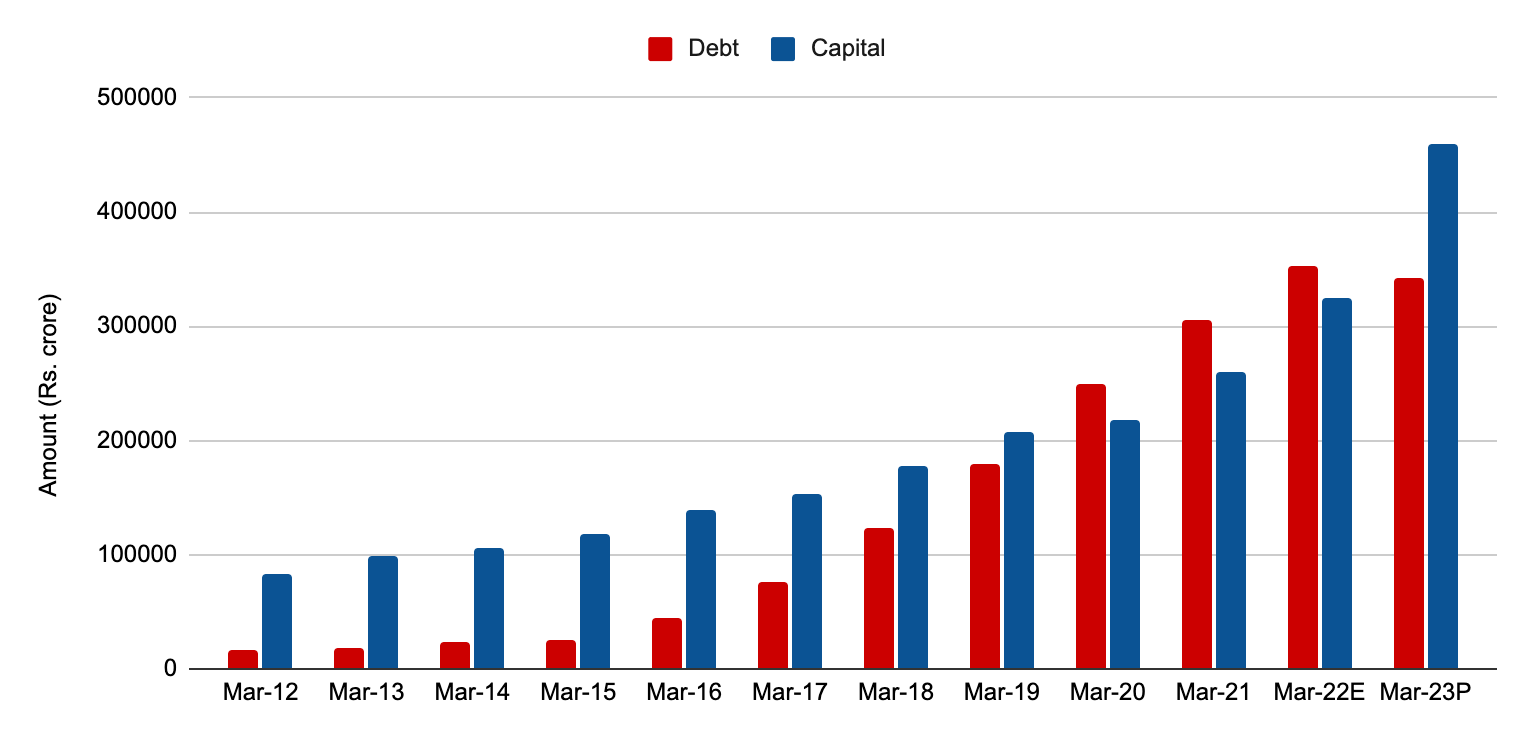

Over the years, dependence of NHAI on external borrowings has increased significantly with ~50% of its overall funding coming through external debt in FY2022. The total debt has increased by around 20 times over the last decade from Rs. 17,000 crore in Mar’12 to current estimated levels of around Rs. 3.5 lakh crore (shown below).

Union Budget 2022: Good News for NHAI

In the recently presented budget, there has been a big change in policy stance to move to Zero incremental borrowings for NHAI from a level of Rs. 65,000 crore debt raised in each of the last two financial years. The non-dependence on external debt has been compensated by a significant increase of 154% in CRIF allocation to Rs. 1 lakh crore in FY2023 BE from Rs. 0.4 lakh crore in FY2022 RE, which also reflects Government’s strong focus on building road infrastructure.

Did This Union Budget Miss Out on Road Development?

However, disappointment stems from the very low increase in overall budgetary allocations to the Roads sector; the outlay for MoRTH has been kept almost stagnant while increasing by only 1.5% in FY2023 BE to Rs. 1.99 lakh crore as compared with FY2022 RE and 9% from FY2022 BE. Last year the increase in MoRTH’s outlay was a reasonable 20%. For NHAI as well, the increase remains paltry 3% from Rs. 1.30 lakh crore in FY22 to Rs. 1.34 lakh crore.

The increase has been much lower than the market expectations and is not commensurate with the expected fund requirements for timely completion of Bharatmala Pariyojana. The pending construction cost for national highways under NIP is estimated at around Rs. 21 lakh crore (assuming ~70% share for Central road projects) and is to be expensed by FY2025. Given this backdrop, FY2023 allocations should have been around Rs. 2.5 lakh crore to ramp-up the execution pace and to meet the targets of its ambitious plans under NIP for the road sector.

Road awards in the recent past had been a mix of HAM and EPC projects; possibly with the limited increase in outlay this year coupled with high award/completion targets, the mix of awards may tilt towards more of HAM projects which will limit upfront funding requirements for NHAI. Also, NHAI may take up larger projects in SPV structure such as one done for Delhi-Mumbai expressway (DME Development Limited), where the debt funding will be raised by SPV itself with limited support from NHAI.

The government has set a target of completion of 25,000 km of national highways in FY2023 while it has constructed 6185 km of national highways in 9M FY2022 and 13327 km in FY2021.

All Things Union Budget, here!

As we wait and watch how the Union Budget 2022 will turn out for the country, it will be exciting to see the impact on the Infrastructure sector. To stay in tune with all things Budget 2022, check out CredAvenue’s curated Budget portal, in association with MoneyControl, here.

Shubham Jain, Chief Business Officer – Infrastructure & Real Estate Platform at CredAvenue will also break down the Budget announcements in a virtual masterclass on ‘Decoding Budget 2022 announcements and their implications on the Infra sector’ with Mangalam Maloo, Senior Research Analyst & Market Anchor at CNBC-TV18.