In the past few years, the government has been quite open to taking feedback from the industry to improve developers’ attractiveness of the BOT (built, operate and transfer) models. With the launch of the Hybrid Annuity Model (HAM) in 2016, the government has, in a way, filled the gap between EPC (engineering, procurement and construction) and BOT – Toll/Annuity. The model’s success has resulted in adoption of a similar mechanism by other State Road Authorities/departments and for non-road projects (sewage treatment plants, State water and sanitation departments).

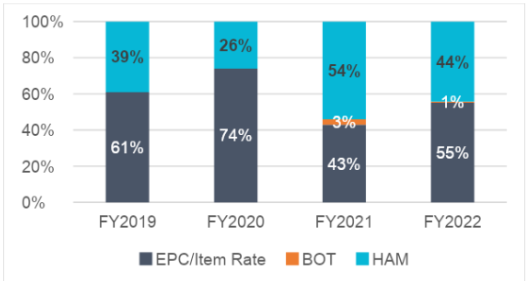

Exhibit 1: NHAI Award Trend

Exhibit 1: NHAI Award Trend

HAM and EPC remain the preferred mode of the award, with 44% (~66% in terms of cost) and 55% of NHAI projects being awarded through HAM and EPC mode, respectively, in FY2022. The impetus and momentum of HAM project awards are expected to remain robust with all the changes made in the recent past.

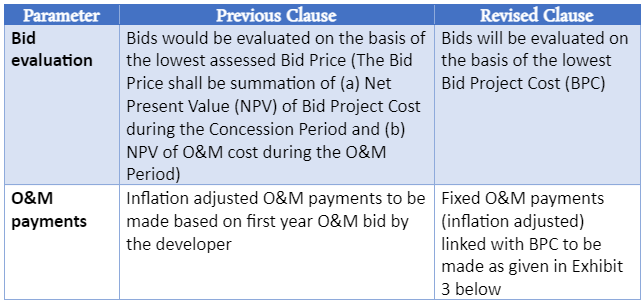

The HAM projects are currently being awarded on the basis of the lowest assessed Bid Price, which is the summation of (a) Net Present Value (NPV) of Bid Project Cost during the Concession Period and (b) NPV of O&M cost during the O&M Period).

With the heightened competition in the segment mainly posts the relaxations in the bid eligibility criteria provided by the Ministry of Road Transport and Highways (MoRTH) in Oct 2020, we have witnessed many developers playing around with the O&M costs.

There has been an instance wherein the developer has put in a bid with negative O&M cost; that bid was rejected by the Authority to upfront the profits and grants available. The lenders/investors have been wary of the extremely low O&M bids made by the developers as against the actual/expected O&M costs, thus exposing the project to risks of poor maintenance and cost overruns. To handle this situation, MoRTH, vide it’s circular dated May 23, 2022, has allowed the lowest quoted Bid Project Cost (BPC) as a basis for awarding the HAM project and operation & maintenance (O&M) cost to be fixed as in EPC projects.

Exhibit 2: Changes in the Concession agreement for HAM project

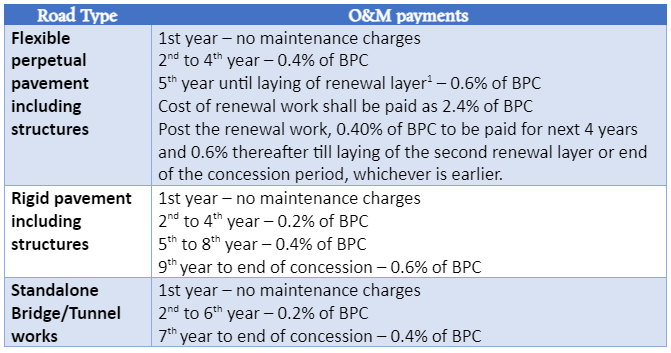

Exhibit 3: Revised O&M payment schedule

NHAI’s earlier model would have been perfect in an ideal situation wherein BPC is in line with total project cost and O&M bid is in line with actual maintenance costs. However, enhanced BPC and lower O&M bids have resulted in better returns, and upfront profits/returns for the developers as grant payment 40% of inflation-adjusted BPC NHAI is linked to BPC and not O&M. Higher NHAI grant as a source of funding also reduces the debt sizing and developer’s equity stake.

As per the revised guidelines, the linkage of O&M payments to BPC is expected to improve the overall bidding discipline and enhance the skin in the game for promoters/developers. This change is also expected to catalyse the M&A activity in the HAM segment as inadequate O&M payments have been a concern for the investors. Adequate O&M remains crucial for HAM projects as future annuities depend on appropriate road maintenance.

The changes mentioned in O&M payments will also ensure the quality of O&M work being executed on the project stretch as the payments for renewal work will be paid based on the pavement condition. Renewal work forms a significant component of the overall maintenance costs for a road and is generally required every 5-7 years.

However, the adequacy of the payment to be made by NHAI compared to the actual O&M costs remains to be seen. Further, the non-recourse nature of SPV funding will expose lenders to steep inflation cycles, which are currently covered by a limited undertaking from sponsors. O&M payments through inflation-adjusted will not cover the inflation risk in case of a steep rise in prices of key raw materials like steel, bitumen, cement etc.

The linkage of O&M with BPC remains the same irrespective of the proportion of structural work in the project cost. Generally, the projects with higher structural work in scope tend to have higher BPC and lower O&M requirements, which is expected to benefit those with higher structural work.

In another circular, MoRTH has permitted a change in ownership of BOT (Toll) projects to 1 year. A period of one year will be reckoned from the date of completion of the punch list from 2 years after the commercial operations date (CoD), provided that the concessionaire is not defaulting payment of premium to NHAI (if applicable) and O&M obligations. This, along with the other changes in = the model concession agreement (MCA) of BOT (toll) in the recent past, is expected to provide the required impetus to attract the M&A market for these projects.

Further, 97% fastag penetration has brought in more transparency for toll collections and is expected to support the valuations for BOT (toll) assets with a limited track record. There are only a few new BOT (Toll) projects and some legacy projects that would benefit from this change. However, this would provide flexibility for the upcoming projects.