CredAvenue Tax-Free Bonds

What are Tax-Free Bonds?

Tax-free bonds are government bonds that aim to provide a regular tax-free coupon income. Also known as tax-free government bonds, these bonds can only be issued by government bodies, such as municipal corporations, NHAI, etc., for raising funds for development projects. These bonds are issued for the long term only. Hence, they can also be called tax-free municipal bonds.

However, you must ensure that you do not need to withdraw the invested money anytime soon. This is because the lock-in period for such bonds is more than 10 years since the money is raised by the government for big projects. You can alternatively trade these bonds on the bond markets if they are listed.

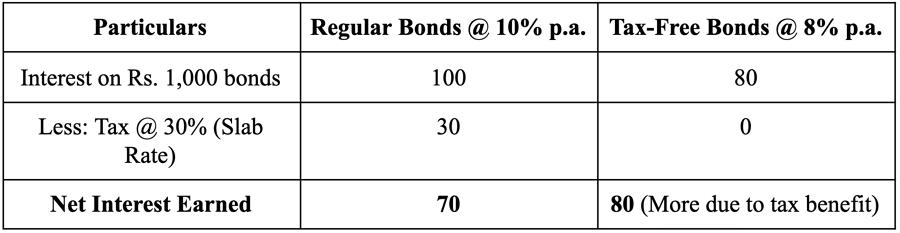

The following table depicts the difference between the returns of a tax-free and a regular bond. The interest payout on tax-free bonds is lesser than regular bonds due to tax relaxation. The coupon rate at which interest is paid can also be called tax-free bonds yield.

However, it must be noted that only the interest on such bonds is tax-free. The capital gains arising from selling the bonds or through redemption after the tenure are taxable. Tax-free bonds in India issued by agencies like NHAI or REC are very popular.

Features & Benefits of Tax-Free Bonds

✓ Fixed Interest Rate: The interest on non-taxable bonds is fixed and is payable at regular intervals. You will receive this amount until the maturity of the bond. The interest amount is usually risk-free due to the involvement of government corporations. The interest payout on these bonds is usually made half-yearly or yearly.

✓ Tax-Free Returns: You do not have to pay any taxes on the interest received by you on these bonds. Hence, the interest rates can be called the tax-free bond’s rate. Although, the capital gain on sale or redemption of these bonds is taxable under the Income Tax Act, 1961.

✓ Highly Secure: The investment in these bonds is highly secure. There are hardly any chances for default on a government bond. This quality makes them the most attractive bonds for investment.

✓ Less Liquid: There is a minimum lock-in period on tax-free infrastructure bonds. You cannot withdraw money from these bonds before the completion of this tenure. Hence, these bonds are less liquid as compared to other investments.

✓ Long Tenure: Bonds related to infrastructure are issued by government departments like NHAI, REC, etc. Since the projects undertaken by these departments are for a long time, the tenure is usually more than 10 years.

How Can You Invest in Tax-Free Bonds?

You can invest in a tax-free bond in 2 ways:

Bond Issue: You can apply for these bonds while the subscription is open. Both online and offline applications can be filed by filling a form and submitting your KYC details, including your PAN Card.

Through Trading: Post-issuance, tax-free bonds can be purchased online using a trading account through a broker.

These bonds are tradable in the stock market through your Demat account.

Government Departments issue tax-free bonds for various projects from time to time. Hence, you must keep a track of the upcoming tax-free bonds issue. It is beneficial to invest in such bonds at the issue price because as the bond prices rise, it becomes less feasible to invest in them due to lesser interest payouts remaining.

Why Should You Invest in Tax-Free Bonds?

Compared to volatile markets and risky investments, tax-free bonds are a much better option if you are highly risk-averse. It can help you earn a regular income for a long period, along with the benefit of capital gains.

Online Fintech platforms like CredAvenue build a nexus between the investors and the borrowers to carry out transactions smoothly within a highly secure environment. With 100% transparency and simplicity, you can easily invest in your favorite tax-free bonds and track your investments in real-time.

FAQs

Who can issue tax-free bonds?

Tax-free bonds listed on NSE can only be issued by government authorities or departments to raise capital for infrastructure development. The bonds issued by NHAI, REC, HUDCO, NABARD, etc., are popular among investors.

How to get REC tax-free bonds?

You can apply for REC bonds through your broker in offline mode. Alternatively, you can apply online directly through a broker or bank.

Are all types of income on a non-taxable bond tax-free?

No. Only the interest amount is allowed as an exemption. You have to pay taxes on any capital gain earned by selling or redemption of these bonds.

What is the frequency of interest payouts on tax-free bonds?

Usually, the interest payouts are made on a half-yearly or yearly basis.