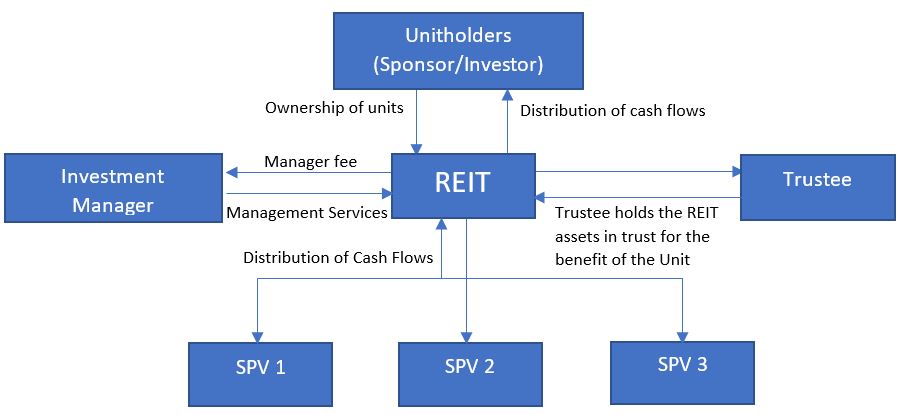

Real Estate Investment Trust (REIT) is a special purpose vehicle (SPV) that owns a bouquet of real estate assets, most of which are income-generating, while some may be under development with a potential to generate stable rental income once completed and leased out.

REIT Structure

A REIT investor is issued units in lieu of their investment into REITs, similar to the issuance of units by a mutual fund to its investor. As the performance of a mutual fund unit is driven by the underlying equity shares (thru capital appreciation/ dividends/share splits etc.). Likewise, dividend/interest income from the operating assets coupled with capital appreciation of the underlying asset drives the pricing of the REIT unit.

The relevance of REIT as an asset class has gained relevance over the years given the investment flexibility it offers to a retail investor by considerably bringing down the investment amount required to own a part of quality commercial real estate asset coupled with diversity (like geographical/end-use) by having a bouquet of buildings in a REIT pot.

The relevance is further enhanced given the liquidity available to exit with the investor, unlike a hard asset. Separately unlocking capital through REITs helps developers to deploy funds for future growth as well as enjoy the benefits of stable cashflows by staying invested in the REITs through their unit holdings.

Global Perspective

Acceptance of REITs has increased globally, given the benefits it offers to both – developer and retail investors. Over 2015-20, nearly $200bn was raised through REITs globally as per a FICCI report. The majority of this fundraising happened in the United States of America, the UK, Singapore, Canada and Australia.

With their acceptance rising, as a structure, over the years, the underlying assets in REITs have also evolved with time. Initially from having commercial office space as underlying assets, there are sector-specific REIT now that have either residential apartments, shopping centres or warehouses as the underlying. Thus, REITs offer a variety of real estate sub-segments to invest in a retail investor.

Indian Context

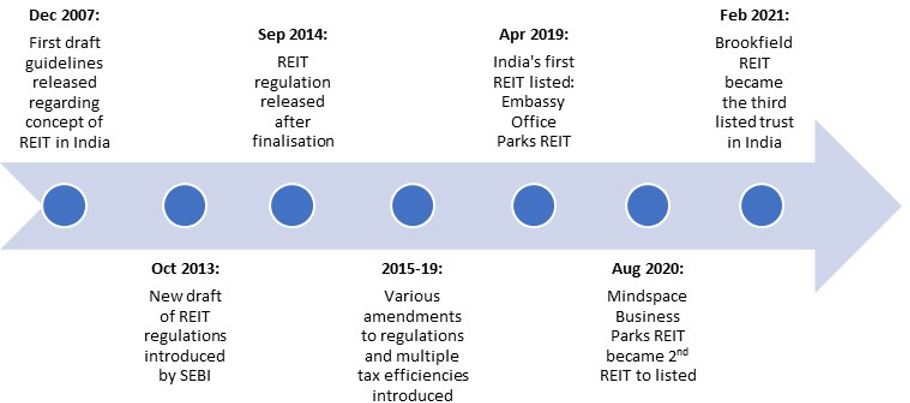

Currently, the Indian REIT market can at best be classified in its ‘start-up’ mode. Since the initiation of the regulatory framework for REITs by SEBI in 2013, the majority of the time until the first REITs (2019) was spent progressively aligning the framework to make it stakeholder friendly.

For e.g. Indian regulatory framework mandates REITs to have at least 80% operational assets, thereby limiting exposure to construction risk, paying out 90% of the distributable cash flows that provide for a stable income stream, and reducing minimum application value, among many other retail investor-friendly guidelines.

Evolution of REIT in India

The potential for development of the REIT market remains huge given the un’REIT’ed Grade A Indian office space. Since 2019 three REITs have been listed – India’s first Embassy Office Park in 2019, followed by Mindspace Business Park REIT in 2020 and Brookefield REIT in 2021. It will be safe to believe given the nascent stage of REIT markets and promoting active retail participation, the regulatory oversight will remain proactive, which will further facilitate the development of the market, thereby improving the confidence of retail investors.

Why is REIT relevant for retail investors?

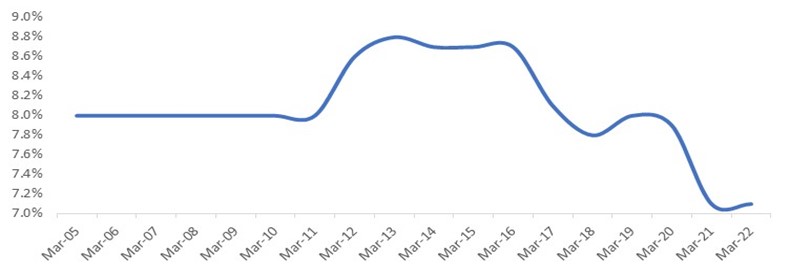

The potential a REIT investment provides to retail investors viz-a-viz ease of investment, transparency through disclosures, and consistency of returns merits a closer evaluation of REITs as an asset class by a retail investor. Traditionally Indian retail investors’ preference has been towards debt-oriented safe products like FDs, NSCs, and PPF. However, given the diminishing returns these products offer in current times, there is an ever-compelling case for the retail investor to consider and apportion some part of the investment portfolio towards REITs.

The trend in PPF Rate of Interest over the years (2005 onwards)

Apart from offering relatively better returns, REITs also provide an alternate asset class (i.e. real estate) to the retail investor. It is worth highlighting that Indians have historically preferred real estate as an investment class, although this asset has been out of bounds for the masses due to the need for large capital to procure it. Interestingly, REITs offer retail investors a way to overcome this challenge. Separately ease of liquidating the REIT units through open market transactions enhances the liquidity benefit REIT offers to a retail investor.

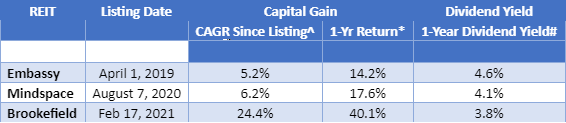

REIT Returns: Capital Gain and Dividend Yield

Source: Trendlyne; ^CAGR of unit price since the launch of REIT till Mar’22; *1-Year absolute return (Apr’21-Mar’22) of unit price; #calculated over the 12-months period preceding latest dividend declaration date by REIT

What is in REIT for a retail investor?

- Stable income stream: By virtue of its design REITs largely have Grade A leased commercial office space as the underlying asset. Typically, these assets have long term leases, thereby providing a stable revenue stream for the REIT. Further, REITs must distribute 90% of their earnings, providing a stable income stream to the unitholders over the medium to long term.

- Capital appreciation: An increase in the price of assets further enhances the valuation of the REIT pot, thereby providing for an upside to the unit holders because of rising capital values.

- Liquidity: Typical commercial real estate transactions can be cumbersome with a high illiquidity premium attached to them. However, REIT offers the flexibility to trade in small lots on stock exchanges, similar to equity trading. The reduction in REIT trading lot by SEBI in June 2021 further enhanced the market depth.

- Diversification: Apart from offering a stream of stable income presence of a bouquet of properties within the REIT pot diversifies any risks arising out of concentration viz-a-viz regional as well as a single property for the investor.

- Tax efficiency: Dividends paid by REITs in the hands of unitholders are exempt from tax, provided the SPVs under the REIT have not opted for corporate tax rate under the concessional regime (u/s 115BAA)

- Strong corporate governance and disclosures: Association of strong promoters and the presence of professional managers strengthen the corporate governance standards. Indian REIT market currently enjoys the benefit of many international marquee investors being unitholders, the presence of whom strengthens the standard of governance. Additionally, regulatory requirements like disclosure, annual valuations etc., bring in transparency. The availability of timely information helps investors make informed decisions.

- Relatively better returns: The returns earned by REITs until now have been relatively superior to many of the fixed income products (like FD, RD, NSC) that retail investors favour. Notwithstanding the associated business risks, the track record of superior returns of REIT indeed is a consequence of combining the factors discussed above.

A glimpse into the future

The current Indian Office Market is estimated to be around 700-750 mn sq ft. of which nearly 50-60% would be a plausible candidate for REIT listing. This provides a tremendous market potential for REITs as an asset class for the investor.

Despite the blip caused by Covid-19, traction in the office market remains positive, highlighting the strong inherent demand from various industries, especially ITeS, new emerging tech start-ups, consulting, and the BFSI domain. The sustainable advantage drives the uptick in demand from these industries India offers in terms of human capital, improving standards of infrastructure and rental cost arbitrage (in $ terms, Indian Grade A space costs sub $1-$3 per sq. ft. vs more than $6 in other key regions like Hong Kong, Singapore etc.).

The resilience which REITs and their underlying asset class (Indian REIT market is dominated by commercial office space as an underlying!) have demonstrated during Covid-19 and the following period, coupled with the benefits they offer for a retail investor, clearly make them an investment alternative worth considering when designing one’s portfolio.