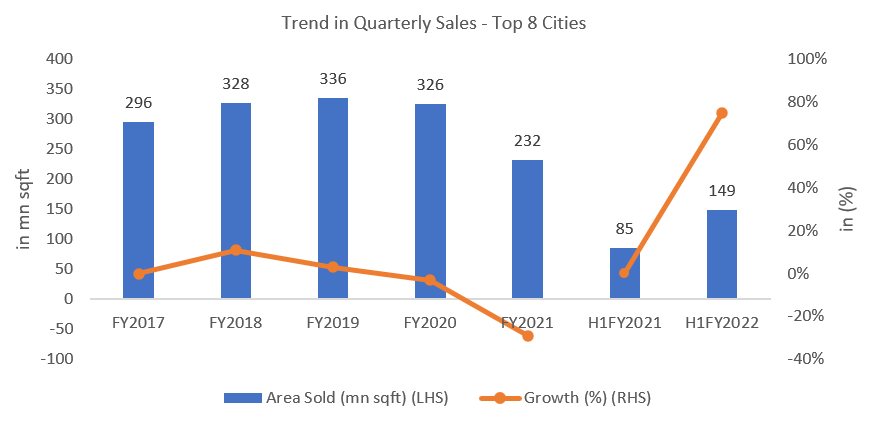

The residential real estate has bounced back despite the disruption caused by Covid-19, on the back of an all-time- low rate of interest on home loans, pent-up demand, incentives by certain State Governments which have supported residential unit buying. The sales of residential real estate grew by a healthy 75% in H1 FY2022 on YoY basis with the top eight cities witnessing sales of 149 mn sq ft area in H1 FY2022 vs 85 mn sq ft in H1 FY2021.

The broader market is gradually catching up to pre-Covid levels on a Y-o-Y basis,. In Q2 FY2021, top 8 cities have registered monthly sales of 81.5 mn sqft area as against the average monthly levels of 83 mn sqft in pre covid period of Q1FY2020 to Q3FY2020. The growth is duly fuelled by the traction seen in the affordable and mid-income housing units (priced upto Rs 1 crore) which has seen significant improvement (41% increase in total units sold in CY2021 vs CY2020 in both the segments) given the low interest rates and incentives like interest subsidy under Pradhan Mantri Awas Yojna provided by the government as well as attractive marketing schemes run by the developers.

Source: ICRA Research

Buyers favouring large developers over smaller ones

Interestingly the impact of pandemic is relatively less pronounced over the large organized real estate players as compared to small/unorganised players. The same was on account of demand consolidation towards the larger developers with a good brand and track record of timely delivery and quality of construction. Many small players have been facing delivery issues due to their inability to tie-up the last mile funding given their already leveraged balance sheet.

This, coupled with sluggish demand environment (FY15-19), followed by pandemic had put pressure on cash flows of such players. A direct fall-out of this turmoil was restrictions on their operations and cash flows and negative market perception of mid-scale builders. This along with the implementation of RERA and GST had supported the market position of the larger players. Low leverage, healthy balance sheets and sufficient liquidity have enabled larger developers to withstand the disruption of the pandemic and prevailing market conditions better than smaller players.

Also Read: Will The Real Estate Demand Momentum Sustain in FY23 ?

As a result, large developers have been a key beneficiary of the market conditions and the clear preference of the home buyers to favour developers having a strong track record of quality and timely execution. Meanwhile, many weak players having land banks have joined hands with large developers through Joint Development/ Joint Ventures and Development Management formats to leverage the market strength of bigger developer and develop these land parcels.

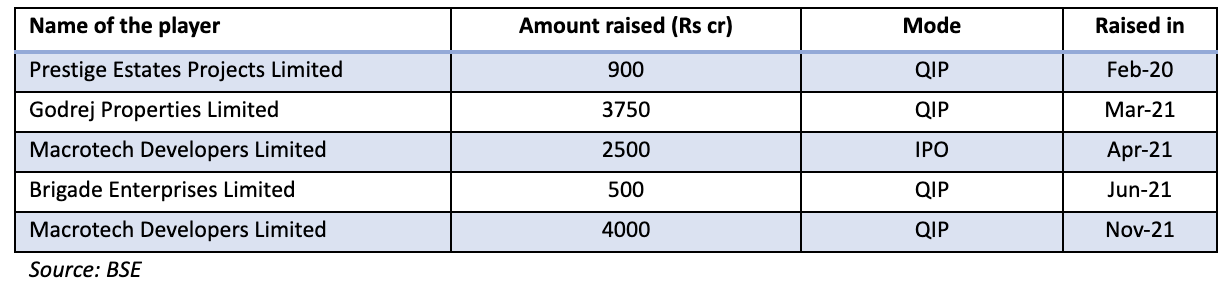

Fund raising of key developers to strengthen the liquidity

Some of the large-listed players have raised funds through IPO/QIP in the recent past to strengthen their liquidity position, to de-leverage their balance sheet and to fund project execution including new launches, further enabling them to increase the market share. Bangalore based real estate player – Prestige Estates Projects Limited has monetised some of its assets – commercial/ retail/ hospitality assets and maintenance business to Blackstone Group and used the proceeds to reduce debt and for the upcoming development projects, which improved its balance sheet and provided growth capital for the upcoming/planned projects.

Growth for large developers despite broader market de-growth

The top listed realty players witnessed healthy growth since FY2017, despite the de-growth witnessed in the broader market from FY2018 to FY2021. The accelerated demand consolidation post the pandemic has increased the market share of the top listed realty players from 6% in FY2017 to 13% in H1FY2022, and the same is expected to benefit the large developers going forward.

Source: Investor’s presentation of the listed players/ ICRA Research

As the large players consolidate their land bank through complete purchase/joint venture/JDA, the market share of larger and stronger developers is likely to increase further given the higher share of large players in the new launches as the economy gradually returns to normalcy.

With many smaller players, who were facing challenges to continue operations in pre-Covid era, having been forced to shut shop due to negative impact of Covid, it is the larger players who are benefitting leading to further consolidation of the real estate supply pipeline. As a result, the end home buyer can also expect good quality product and timely project delivery.