If you are not living under the rock, then chances are high that you might have stumbled upon terms such as InvITs & REITs, the latest progeny in the much-dreaded birth line of financially engineered products. The last large-scale experiment & greed thereto (recall CDOs & CDS) resulted in the global recession. At the same time, the Indian populace at large was insulated from the direct inferno, but the aftermath left none unperturbed. The innocent ‘why’ does immediately rear its ugly head in our minds, but that is a discussion for another time.

Painting the entire gamut with a single brush may not always be prudent. Hence, in the ever dynamic & simultaneously evolving FOMO world, it is important to understand both the products in-depth and then make an informed decision about the darkness of its hue. Starting as a novel investment vehicle to diversify the investor’s base while maintaining a delicate equilibrium between risk & rewards, both InviTs and REITs have caught the imagination of the ultraconservative, FD guzzling retail wealth of the country.

SEBI, through its circular dated September 26, 2014, SEBI notified the broad frameworks of InviTs -Infrastructure Investment Trusts, which paved the way for successful stints of 3 listed & 16 unlisted trusts in the country. For the uninitiated, the trusts house a diversified set of assets and pool their cash flows in one escrow which are up-streamed under various modes to the trust and ultimately to the unitholders of the trust. For further details on the structure of an InvIT, please click here.

There has been a lot of buzz around the InvITs and it can be claimed that various policymakers have not worked in silos to release a half-baked product in a jiffy but have leveraged their aggregate grey matters to knit together a product which addresses the several burning questions both on issuer front (churning of assets/capital) and investor front (reliability of returns/optimum risk matrices). The structural safeguards such as at least 80% of the completed projects, distribution of >90% of the free cash flows, and overall control on leverage are well thought through and provide robustness to the structure.

So now let’s put our analytical hats and understand the returns they have provided in the last few years of listing and compare it with the epitome of risk-free investing i.e. Gsecs of a similar time frame and with more appropriate but relatively unknown cousin Nifty Infra Index.

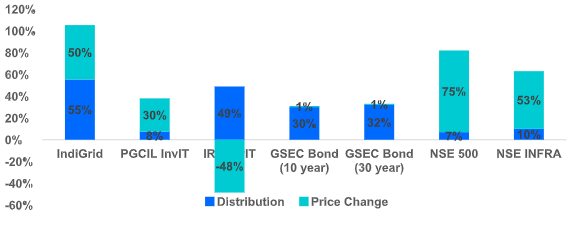

Exhibit 1: Return Analysis across assets^

Source: InvITs Presentation, NSE;

^Indi Grid was listed on 06 Jun’2017, for calculations of returns time period across assets classes has been considered from Jun’17 to 31 March ’22. Since IRB & PGCIL InvIT were listed after 2017, data has been analysed from their respective listing date till 31 March 22. Distribution is the aggregate of all the receipts from repayments of interest, principal and dividends.

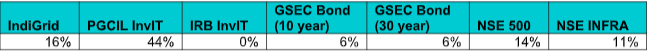

Exhibit 2: Annualized returns

Source: InvITs Presentation, NSE, Average annualised return of the 3 listed InvITs is ~16.5%

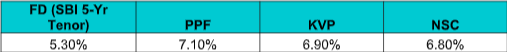

Now since analytical juices are already flowing let’s just use this opportunity to compare the YoY yields with FDs (SBI 5-year tenor), PPFs, and other small saving schemes such as KVP, NSC et.al.

Comparing the yields with the largest liquidity guzzler of the Indian retail market, i.e. Fixed deposits we understand that the average annualised returns of InvITs (including both dividend & capital gains) clearly dwarfs the annual FD yields of even the most enterprising small finance banks/private sector banks (<8%). And all the above returns are pretax returns and don’t include tax arbitrage (skewed towards InvITs) under capital gains and dividend incomes. Flipping through the above hyperlink, assuming you are a fellow lazy soul, let me list the three regular (almost) revenue streams in the hands of unitholders, i.e. dividend, interest and principal. The principal is completely tax-free, and so is the dividend (assuming that the new tax regime u/s 115BAA is not availed). The interest is chargeable at par with the applicable unitholder’s existing slabs. The gain arising out of the sale of units shall also be taxed as per LTCG/STCGs slabs (determined by the holding period).

As you can see, the white horse stands for itself and puts on a show for the ones who bought the tickets. To invigorate the fickled attention of an investor, the most important parameter is the expectation of the return. While few may argue over the priority being awarded to the reward, for them, the answer lies in the success of Ponzi schemes which sell just on the promise of wonderlands. Now imagine that these returns (moderate enough to be assimilated) are coupled with the warmth & comfort of safety (one thing perennially missing from markets), the product that is born of the marriage is InvITs and this is the key reason that these matrimonies are solemnized across the infra-asset classes (roads, transmission, power) and are being continually blessed by the retail investors like you & me.