Construction companies emerged stronger and recovered sharply post-pandemic

Arguably; no one has defined/deliberated upon the ‘Black Swan’ better than Nassim Nicholas Taleb. While the concept has always caught everyone’s fancy but it is certainly a lie if someone admits to anticipating living through it. Come March’20, it became a reality. If succinctness is the measure, then COVID-19 is the best description of ‘At first they will ignore you, then they laugh at you, then they will fight you, and then you win’. The world has never been more topsy turvy than in the last two years; what two world wars, umpteen battles and great economic depression couldn’t achieve has been accomplished by the Invisibles. The health emergency has pushed the conditions of survival of businesses to the limit, having a significant impact on a large part of the national economy and causing great social hardship. Given this backdrop, we have done an aggregate analysis for a sample set of construction entities to ponder upon the financial and operational performance of the construction sector entities over the past few years, particularly amid the Covid-19 pandemic.

Healthy growth in revenue in 9M FY2022 despite the impact of covid supported by strong order book

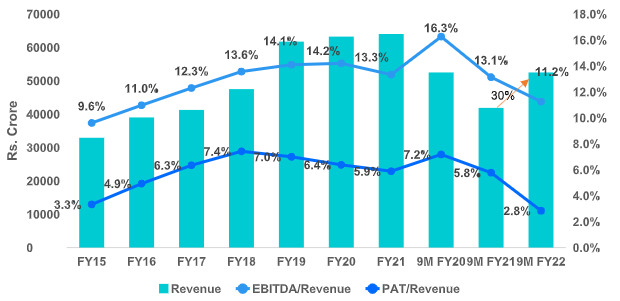

The aggregate revenue of the sample construction companies increased by a healthy CAGR of 14% in the past five years (FY2015-FY2020). However, the growth moderated to 2% in FY2020 and 1% in FY2021 due to the impact of the Covid-19 pandemic and the consequent measures like nationwide lockdown) imposed by the Government, which impacted the execution for all construction companies (logistics issues, raw material, and workforce shortage). This apart, factors like cancellation of some orders, land acquisition delays, etc., also impacted the execution. Revenue increased by 30% in 9M FY2022, albeit on a relatively weaker base than last fiscal (9M FY021). This increase resulted from a strong order book position and a decreased impact of the second wave that imposed fewer restrictions on construction activities. With no major covid restrictions in Q4 FY2022 and a strong pipeline of projects, the EPC (Engineering, Procurement and Construction) companies are expected to book robust revenue growth.

Exhibit 1: Revenue and profitability trend

Source: Company Data (Annual Reports & Presentations)

Profitability is expected to moderate due to a surge in raw material prices and heightened competition

The consolidated operating profitability of the companies contracted to 13.3% in FY2021 and 11.2% in 9M FY2022 from 14.2% in FY2020 due to the surge in raw material prices such as bitumen, steel, cement, and fuel. Many projects have price escalation clauses in the contracts, which reduces the raw material price risk to an extent. However, the contractual escalations are linked to index prices, and the actual increase in raw material prices can be steeper, which impacts the overall profitability. Furthermore, unlike EPC projects, price escalation in HAM (Hybrid Annuity Model) projects is linked to the weighted average of WPI and CPI, increasing the raw material price risk. Net profitability reduced to 2.8% in 9M FY2022 due to lower operating profitability and exceptional losses in a few entities (impairment towards investments in BOT projects). Excluding the exceptional losses, net profitability stands at 4.5% for 9M FY2022. While the increased scale of operations will result in some profits in the near future, profit margins are expected to moderate due to surging raw material prices and heightened competition with the relaxation of bidding criteria, particularly in the road sector. The impact is expected to be higher for companies wherein the order book is skewed towards fixed/defined price contracts.

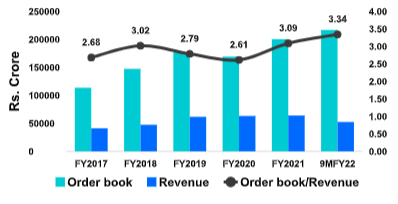

Robust order book position

Exhibit 2: Trend in order book position

Order book position has increased substantially to Rs. 2 lakh crores as of Mar 31, 2021, and Rs. 2.2 lakh crore as of Dec 31, 2021, from Rs. 1.7 lakh crore as of March 31, 2020. Order book to Revenue (FY21) of 3.34 times provides healthy revenue visibility in the near to medium term. The order book is expected to remain strong with a robust pipeline of projects under the National Infrastructure Pipeline (NIP) and the government’s enhanced impetus on infrastructure spending, given the multiplier effect it has on economic growth.

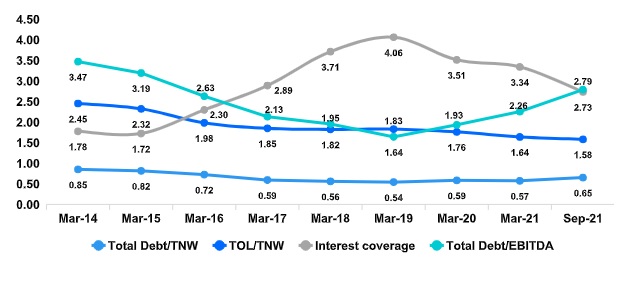

Leverage reduction supported by liquidity relief and improved net worth; however, int coverage moderated due to lower profitability

The aggregate interest coverage declined to 3.51 times in FY2020 and 3.34 times in FY2021 from 4.06 times in FY2019 due to lower OPBDITA, and higher finance expenses on account of higher debt. The finance expenses also include the commission charged on bank guarantees and the interest on mobilisation advances for some entities, which form a substantial portion of overall finance expenses for the EPC players. TOL/TNW improved to 1.64 times as of March 31, 2021, from 1.76 times as of March 31, 2020, with improved net worth despite an increased debt. The government supported EPC players’ working capital cycle and liquidity through the Atmanirbhar Bharat initiative, including an extension of the construction timeline, monthly payment instead of milestone-based payment method, reduction in performance security, and grant of the moratorium etc. With the larger scale and elongation in the working capital cycle post end of liquidity relief measures, TOL is expected to increase. However, accretion to net worth is expected to keep leverage at similar levels.

Exhibit 3: Trend of coverage and leverage ratios

Source: Company Data (Annual Reports & Presentations)

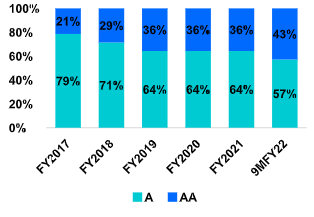

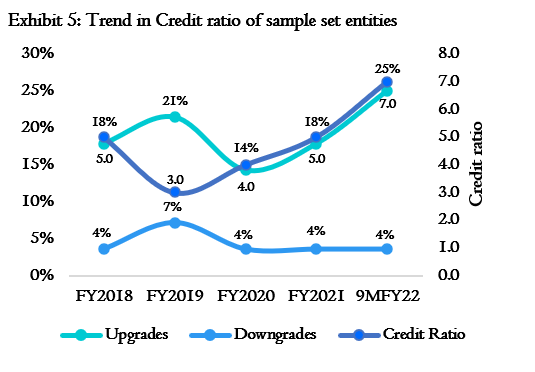

Improvement in credit profile over the past years; expected to remain stable going froward

Over the past five years, the Credit Ratio, a measure of the number of entities upgraded to those downgraded, has been more than three times for the sample set. It has been on an increasing trend since FY2019 despite the impact of Covid. Key reasons for the upgrades include improvement in the financial performance, a substantial increase in order book position, an increase in the scale of operations and improvement in operating profitability etc. Further, there has been an increase in the proportion of entities in the AA category (increased from 21% in FY2017 to 43% in FY2022). The pullback in revenue growth, supported by a strong order book position and pipeline of projects to be awarded together with continued prudent working capital management and healthy balance sheets, is expected to keep the credit profile of infrastructure companies stable.

Exhibit 4: Classification of sample set entities basis rating category

Source: Rating rationales

The near to medium term future looks promising for the construction companies given the strong pipeline of projects to be awarded by the government under NIP. The government has enhanced impetus on infrastructure spending given the multiplier effect it has on economic growth. This is expected to be supported by increased budgetary allocations, timely monetisation of assets planned under NMP and adequate private sector investment. While the increased scale of operations will result in some increased profits in the near future, the profit margins are expected to moderate due to surging raw material prices and heightened competition with the relaxation of bidding criteria, particularly in the road sector. Further, decreasing profitability margins on account of changing macro-economic parameters and adverse impact on returns from the bidding time may result in developers resorting to disputes/delays. Continued prudent working capital management coupled with the extension of liquidity measures until Oct 2022 by MoRTH and healthy balance sheets is expected to keep the credit profile of centre focused infrastructure companies stable. However, entities focused on state government-funded projects could see elongation of the working capital cycle.