Orange Retail Finance India Private Limited (ORFIL) is a Rural Fintech Non-Banking Financial Company registered with the Reserve Bank of India with an endeavour to provide affordable mobility and livelihood solutions to rural as well as semi-urban markets of the Country. ORFIL was founded by Mr. Ebenezer Daniel G, a First Gen Entrepreneur who hails from the Culture Capital of Tamilnadu, i.e. Madurai. ORFIL began its operations in the year 2014 and currently, it has 75 Branches across all the South Indian states, with over 1.3 lakh happy customers, covered over 11200+ villages, generated employment opportunities for more than 4000 people and cumulatively disbursed Rs. 900+ crores with vast last mile rural distribution with an AUM of Rs. 340 crores and thus created an impact in the market it caters. ORFIL’s Primary product offerings include New Two-Wheeler loans, Swift Cash Loans and Loan Against Properties. ORFIL aims to propel the rural market, which is either underserved/unserved by providing easy access to credit.

ORFIL had also recently launched a mobile application named “FINMOBI”, an end-to-end digital platform for sourcing customers online. Customers can know their loan status and pay their EMI’s etc., at their convenience.

The Challenge

Since ORFIL caters to a massive population that resides in semi-urban and rural areas, the company needed a partner with a multitude of lenders in a short period of time to boost their business. Some key challenges that the company faced include:

- It was an uphill task for the company to quickly scale up the number of lending partners. The process was tedious and lengthy.

- Each time ORFIL wanted to get into a strategic partnership with a bank or a lender, the team at ORFIL had to complete a one-on-one integration. One on one integration would have not only choked the bandwidth of the technology team but also increased the time to market.

The Solution

ORFIL team used the CredCo-Lend edge to help them offer joint loans using a smoother interface.

- CredCo-Lend’s one-time integration allowed ORFIL to partner with multiple lenders and helped increase the scope for newer partnerships. The time to market reduced significantly and made ORFIL’s products investment-ready.

- CredAvenue’s CredCo-Lend helped the team at ORFIL get access to a single unified user interface via a customized dashboard to manage their lending business.

- ORFIL got access to suitable investors via execution module assisted in setting up partnerships and configuring contours such as credit parameters, document requirements and commercial details.

CredCo-Lend’s innovative and unique features helped solve multiple problems for ORFIL to help them in their quest of transforming lives.

The Result

After successfully coming on board CredAvenue’s CredCo-Lend, ORFIL was able to reduce their turnaround time for integrating with a lender significantly. More importantly, by partnering with CredCo-Lend, the company increased their loan book and got access to multiple lenders who joined hands with ORFIL to extend their offerings to semi-urban and rural markets.

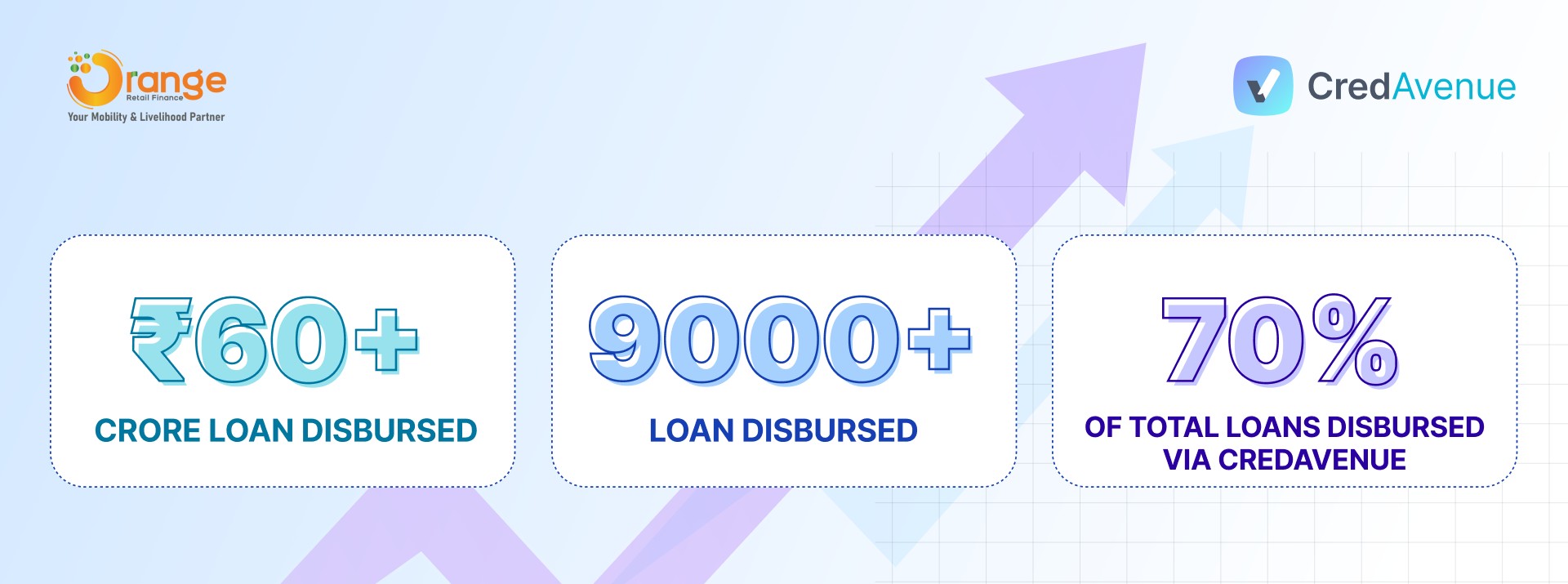

Here are the tangible markers of how ORFIL turned their business around with CredAvenue’s CredCo-Lend:

- Rs 60+ Cr disbursed, quantified to 9000+ new loans

- 70% of total loans disbursed during the period were via CredCo-Lend

- Enhanced data and reporting accuracy

While our clients already speak highly of the platform, we are innovating every day to enhance their experience multifold via technology.

To get a demo of how CredCo-Lend works, please write to us at credcolend@