Greetings from CredAvenue!

We hope you’re having a great experience with CredAvenue. We’ve added a bunch of cool new features and made some major improvements to our CredCo-Lend product.

We enhanced the co-lending stack to enable Investors and originators to partner and transact for Credit Line products. And addressed the key product gaps in the post loan disbursal flow on the CredCo-lend platform.

Let’s deep dive into some of the top recent updates!

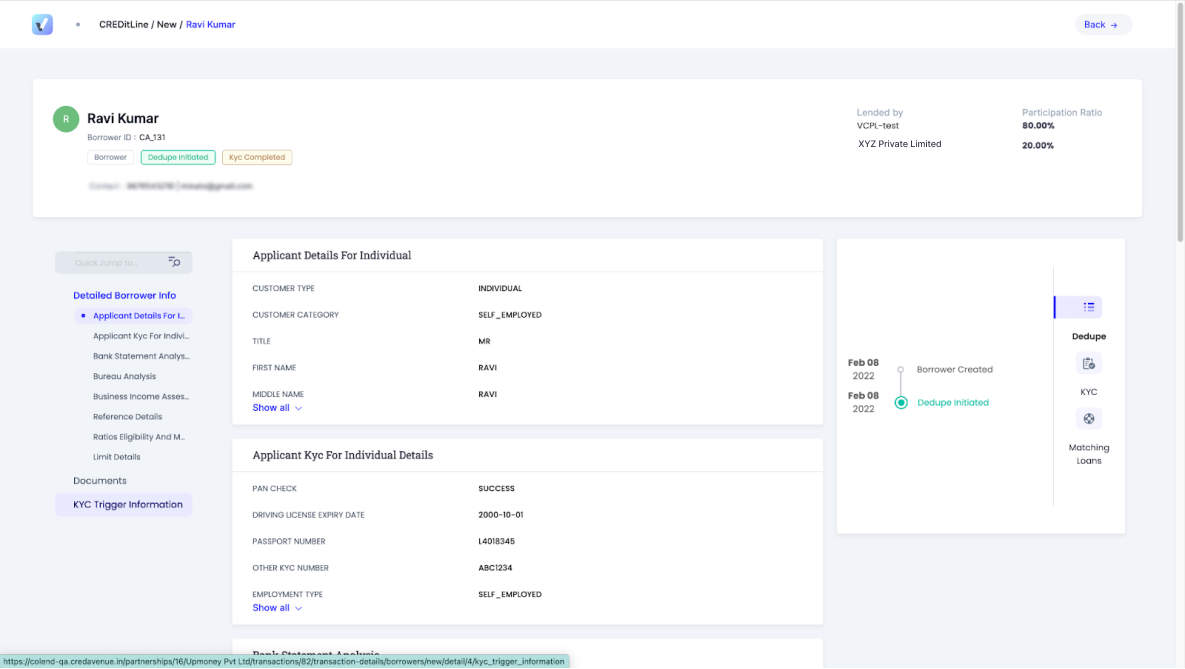

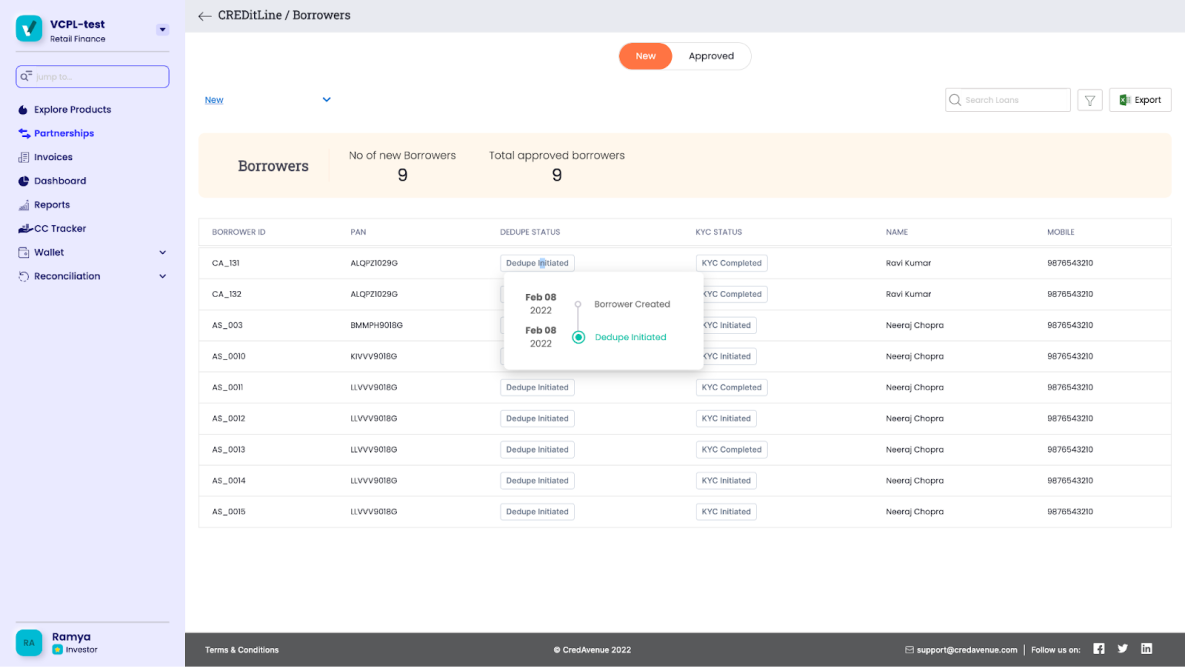

1. Ability to add borrower details on CredCo-Lend

The Problem

The due diligence process for approving and disbursing a loan to the end borrower requires documents and access to the borrower’s details. However, there was no way for the originator to add the borrower’s details on CredAvenue and share it with the lenders before loan approval. Co-lending requires the investor to assess the borrower’s details and then proceed with the process of loan disbursal.

How does the product update solve the problem?

The originators can now share the borrowers’ key details with the investor to help them decide on proceeding with the loan deal or not.

The investors can now view the borrower details and accept or reject the deal.

Moreover, the investors and originators can now configure various checks to filter out borrowers. The originators can also update the borrower’s information on CredAvenue via APIs for only relevant information to be present.

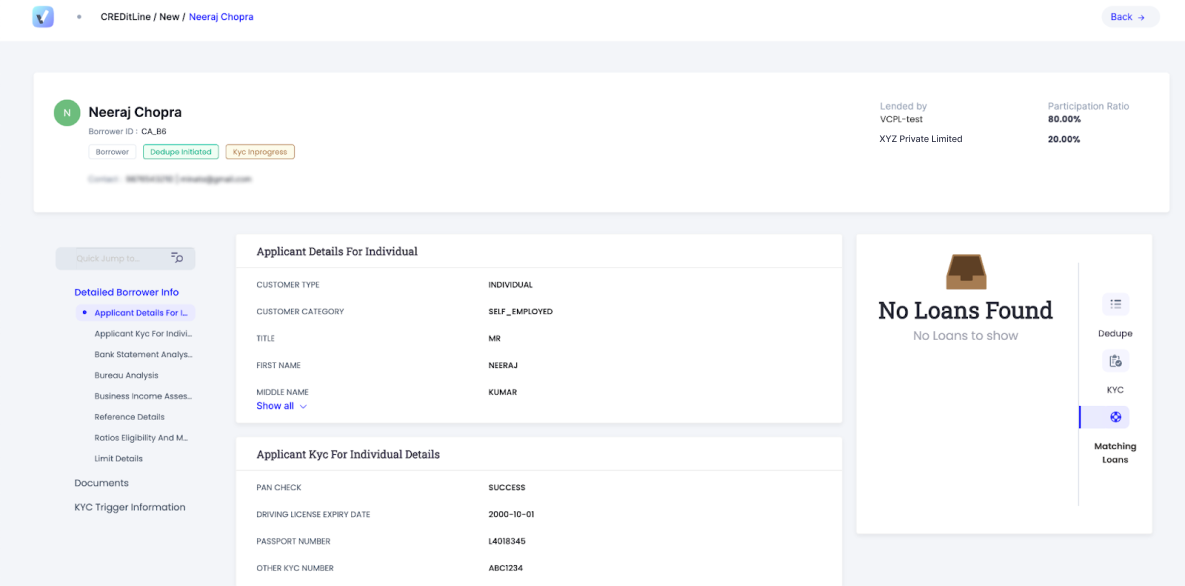

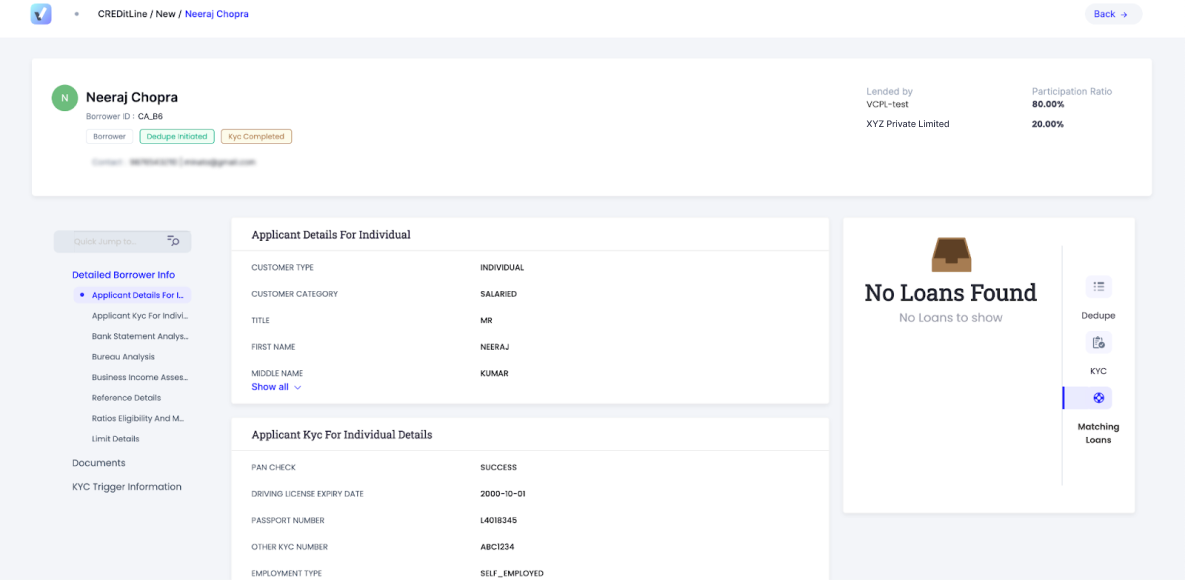

2. CKYC for borrowers on CredAvenue

The Problem

KYC completion and documentation verification form the foundation of the loan underwriting process on CredAvenue.

It is a fundamental requirement expected out of the end borrowers. The originators needed a route to perform the CKYC or Central KYC to deal with entities regulated by Central Government regulators.

How does the product update solve the problem?

The latest update will allow originators to undertake the CKYC verification process via a co-lending investor by sharing the basic identification details of the borrower.

Alternatively, the originator can perform the CKYC process via the CredAvenue platform, integrated with Trackwizz. Investors and borrowers can filter out borrowers by configuring the KYC terms.

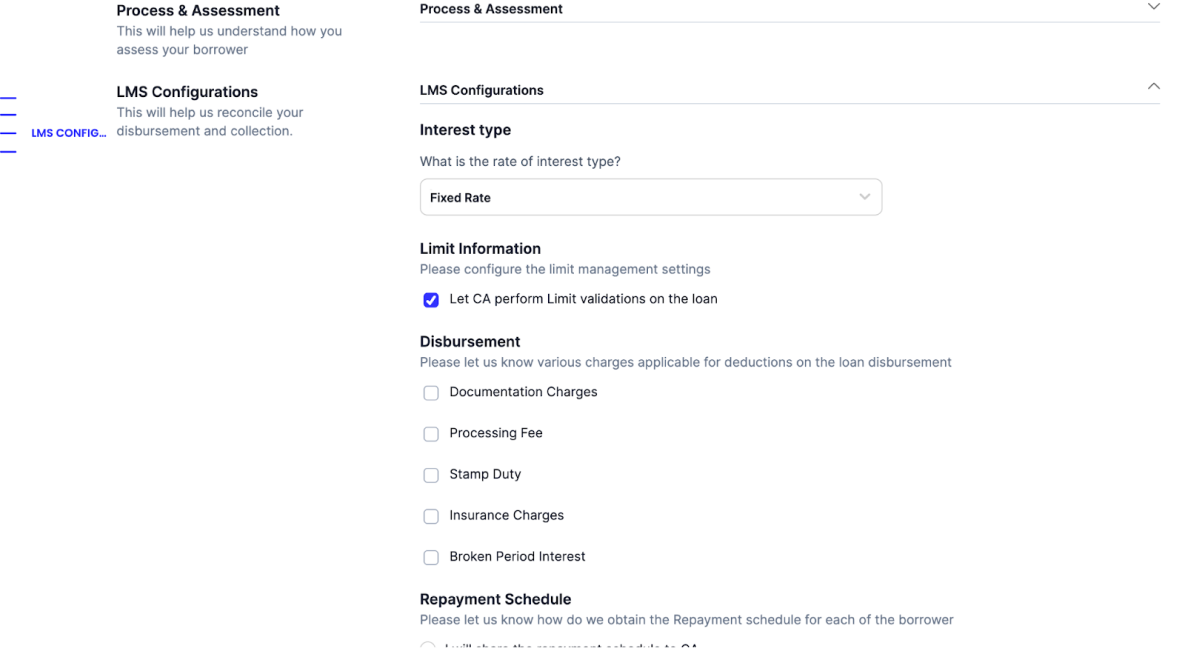

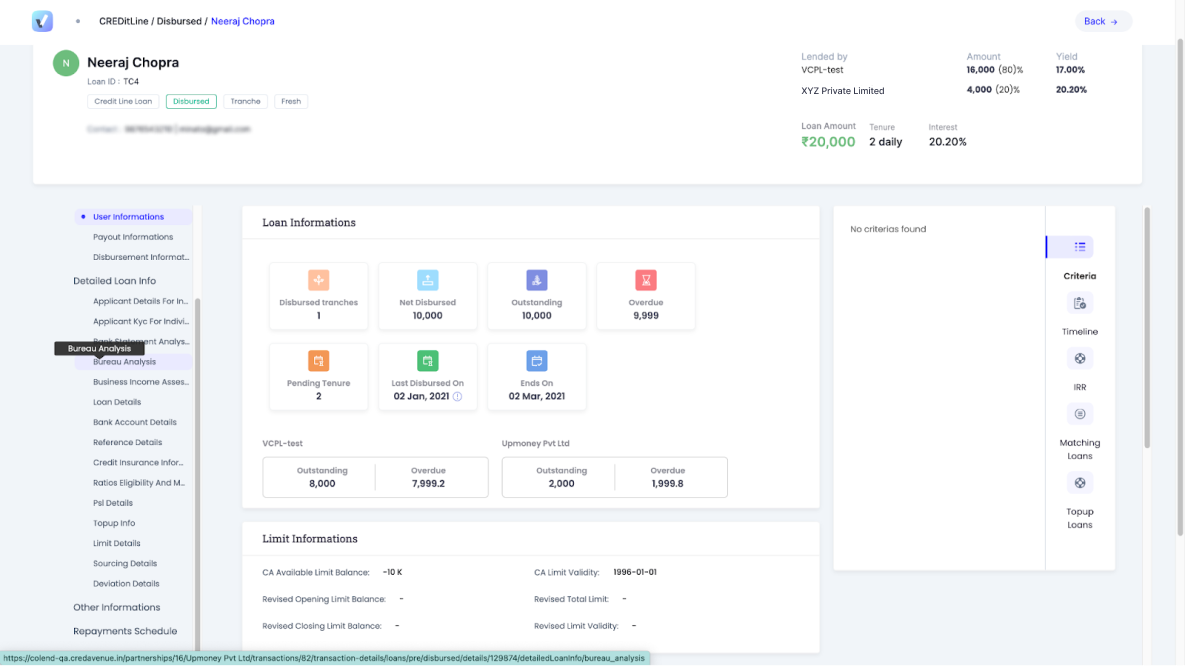

3. Borrower limit checks

The Problem

Each borrower has a specific credit limit. Before extending credit to these borrowers, investors like to check their limits to estimate their creditworthiness. This limit also allowed the investors and the originators to perform validations on the loan deal using the borrower’s available limit. There was no means for the investor to check the borrower limit until now.

How does the product update solve the problem?

After the latest update, the originators will be able to set up a CredLine product on CredAvenue, which will help them view the borrower’s limit details.

Originators will now be able to access the borrower’s total approved limit, opening limit balance, closing limit balance, and limit validity.

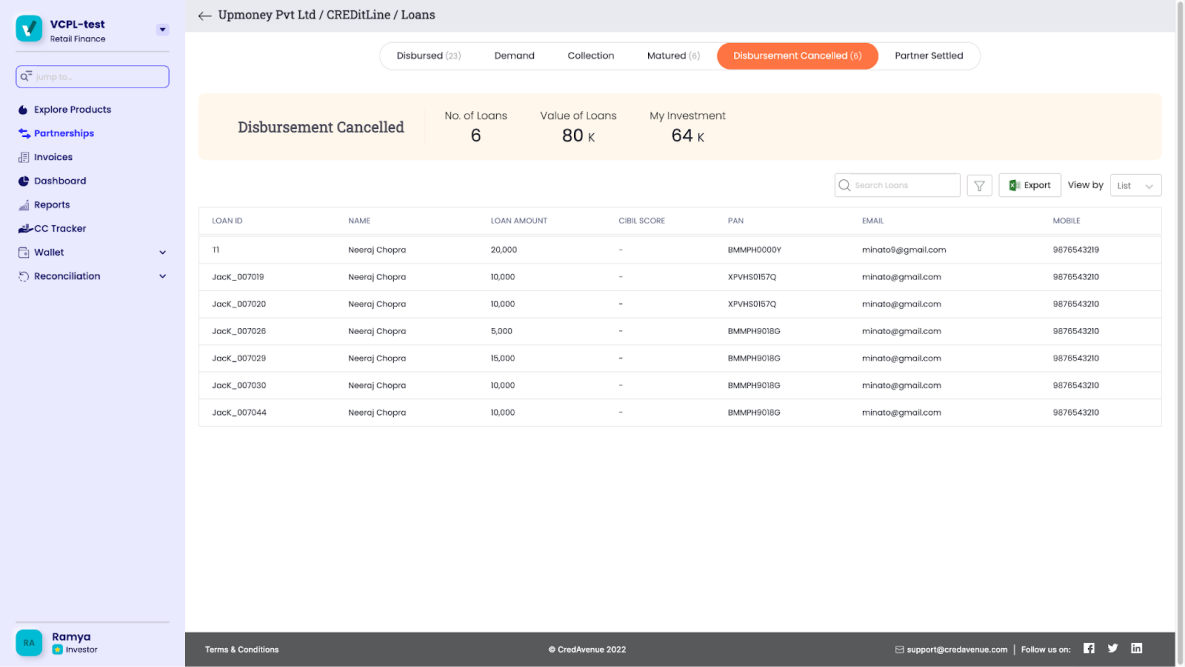

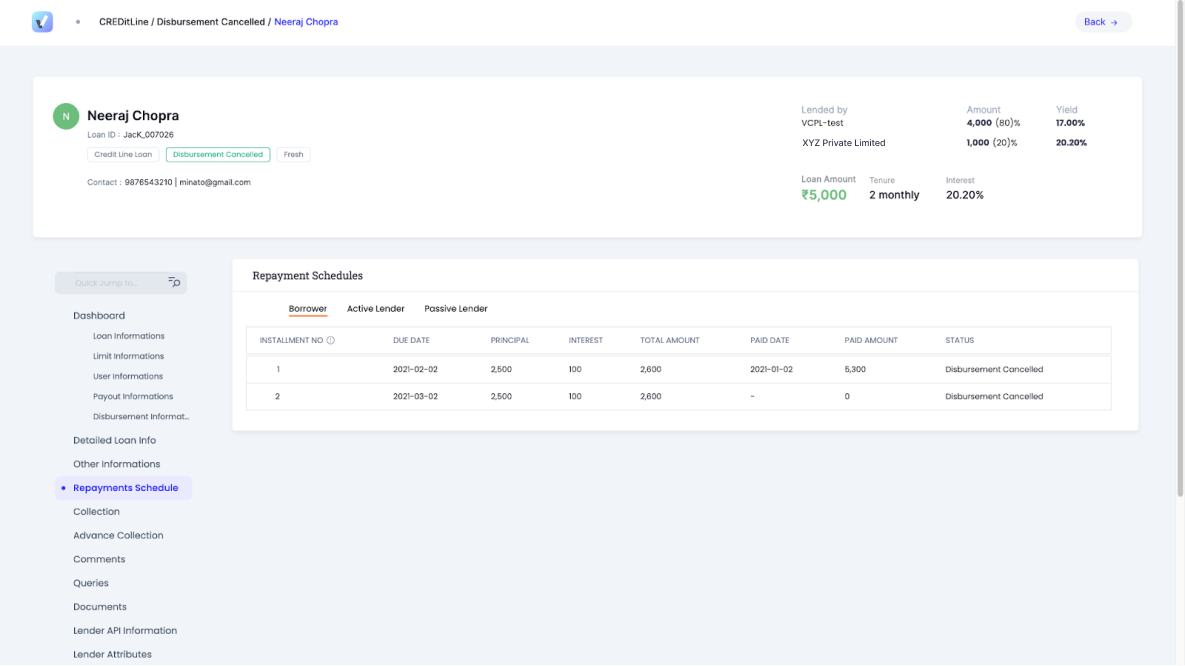

4. Disbursement cancellation flow

The Problem

The erstwhile CredAvenue platform did not allow originators to cancel an approved loan disbursement. If the end customer cancelled the loan application or request, there was no way to stop the sanctioned amount from being disbursed.

How does the product update solve the problem?

The latest product update on CredCo-Lend allows the originator to inform CredAvenue about a disbursement cancellation via API.

There needs to be a set of validations performed on the cancelled disbursement, which can be done by configuring the settings. Once the validations are done, the CredAvenue team will update the loan’s status as ‘cancelled’.

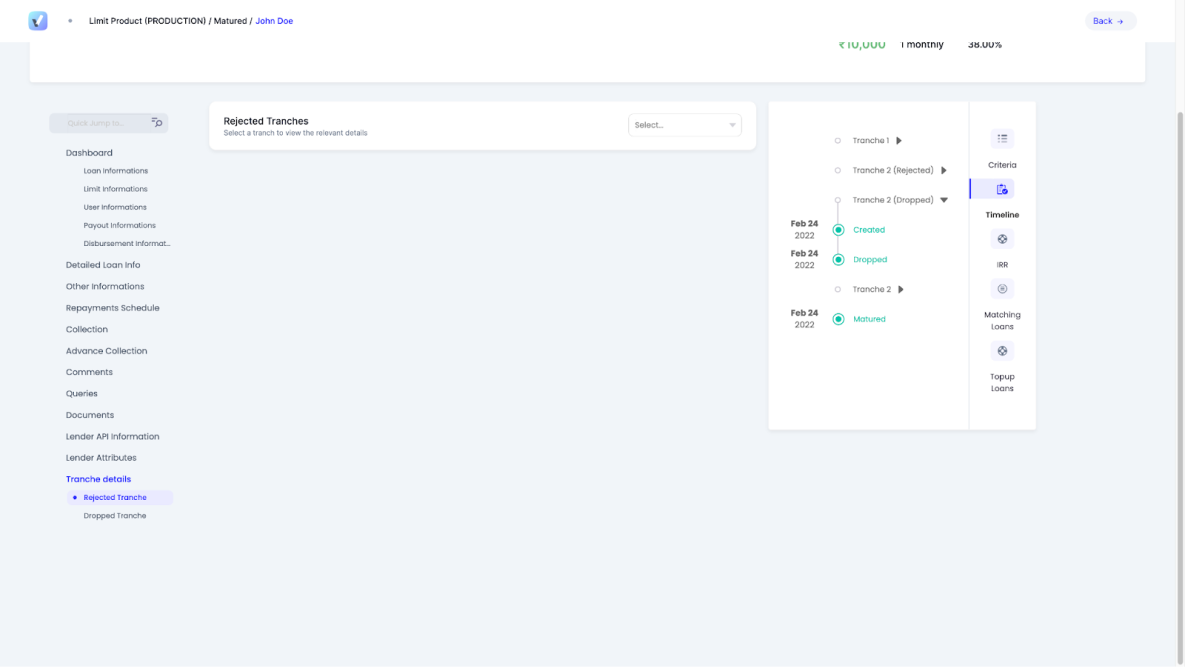

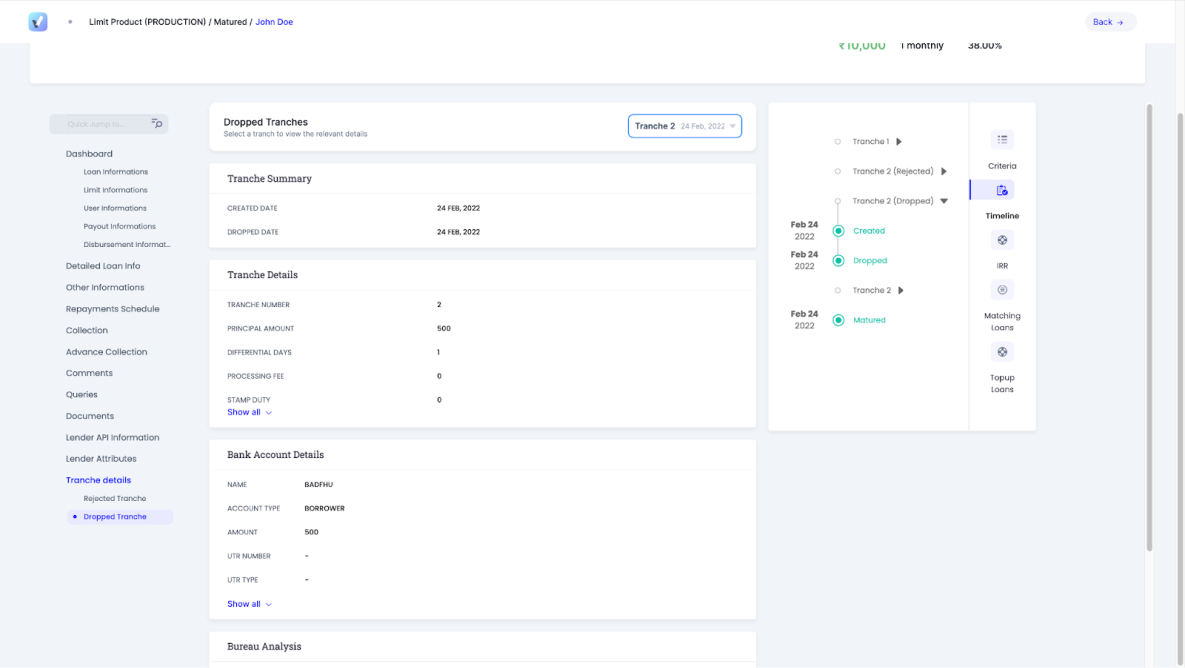

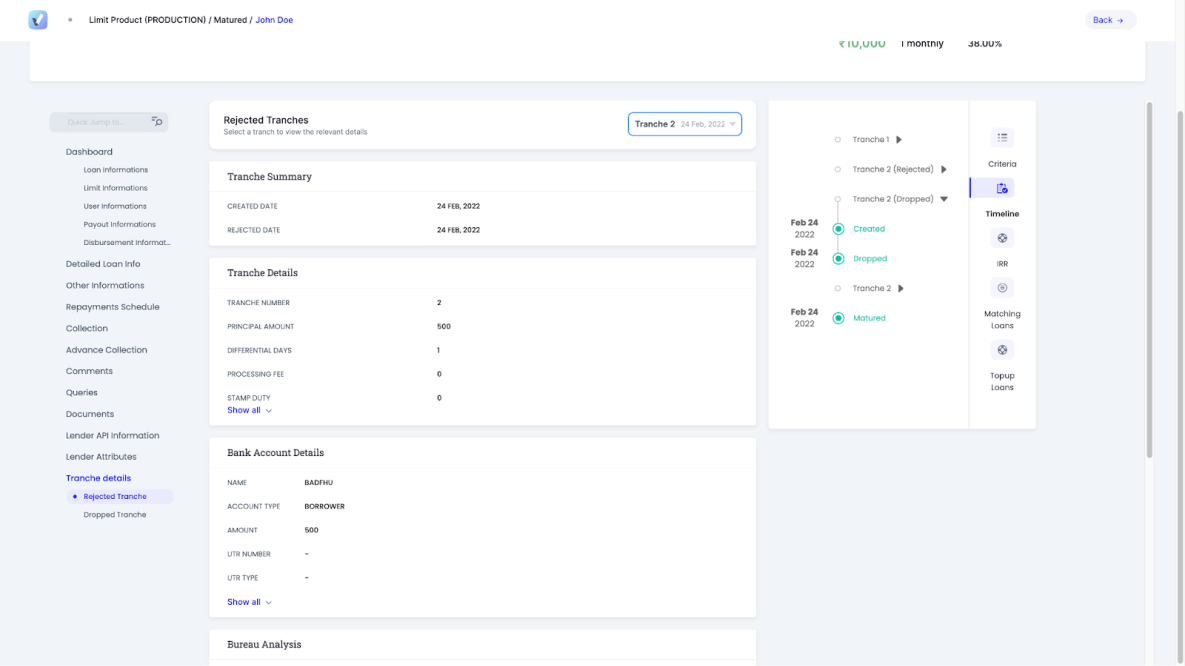

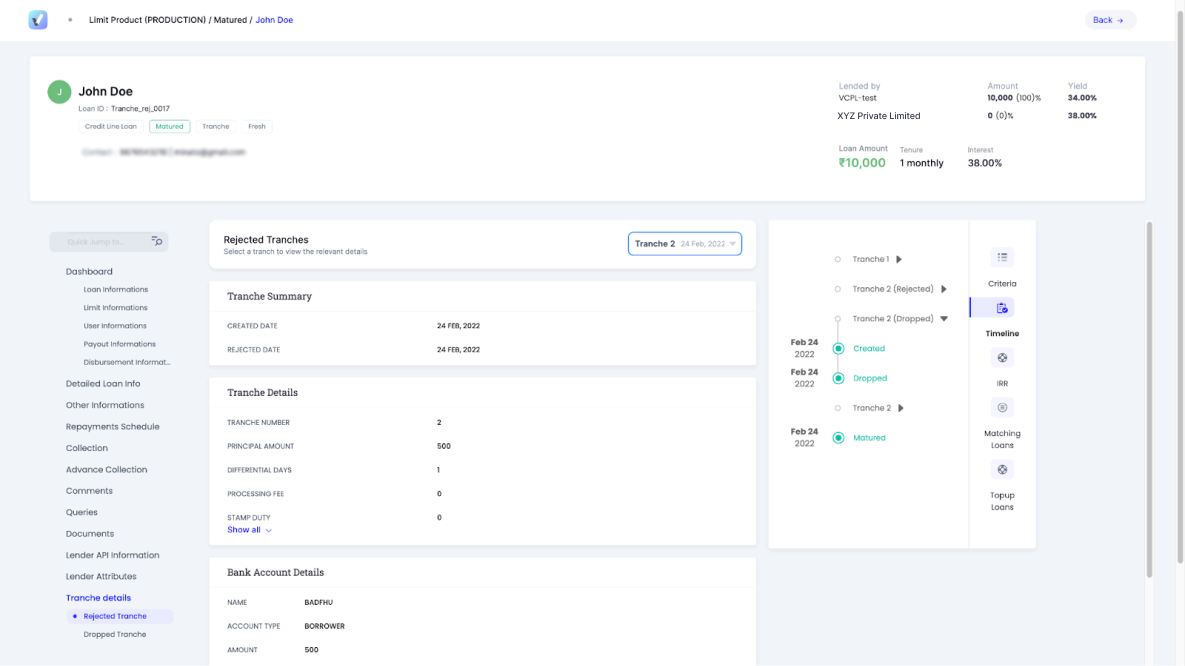

5. Tranche information visibility

The Problem

When tranches are dropped or rejected on the CredAvenue platform, investors require visibility of the same. However, there was no way of updating the investors and originators about the tranche information until now.

How does the product update solve the problem?

Investors and originators can now view the detailed information about the rejected tranches.

They can now view the tranche creation date, rejection/drop date, and the reason for rejection/drop.

Along with this, the tranche timeline and documents for each tranche, the bank and payout details, and disbursement details will also be visible to both investors and originators on the CredCo-lend platform.

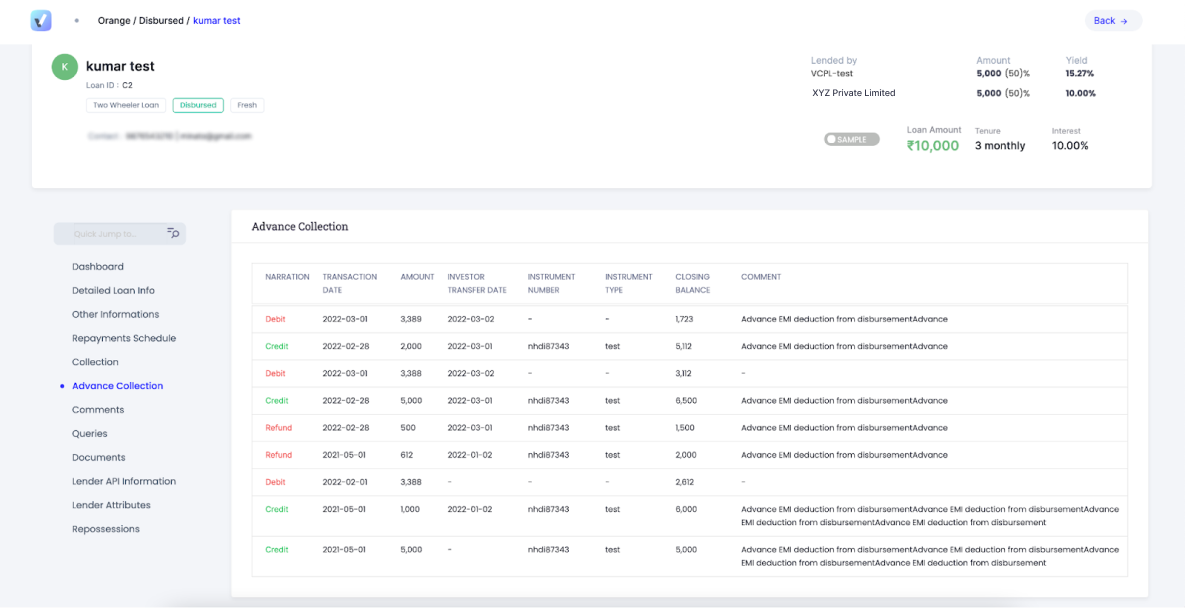

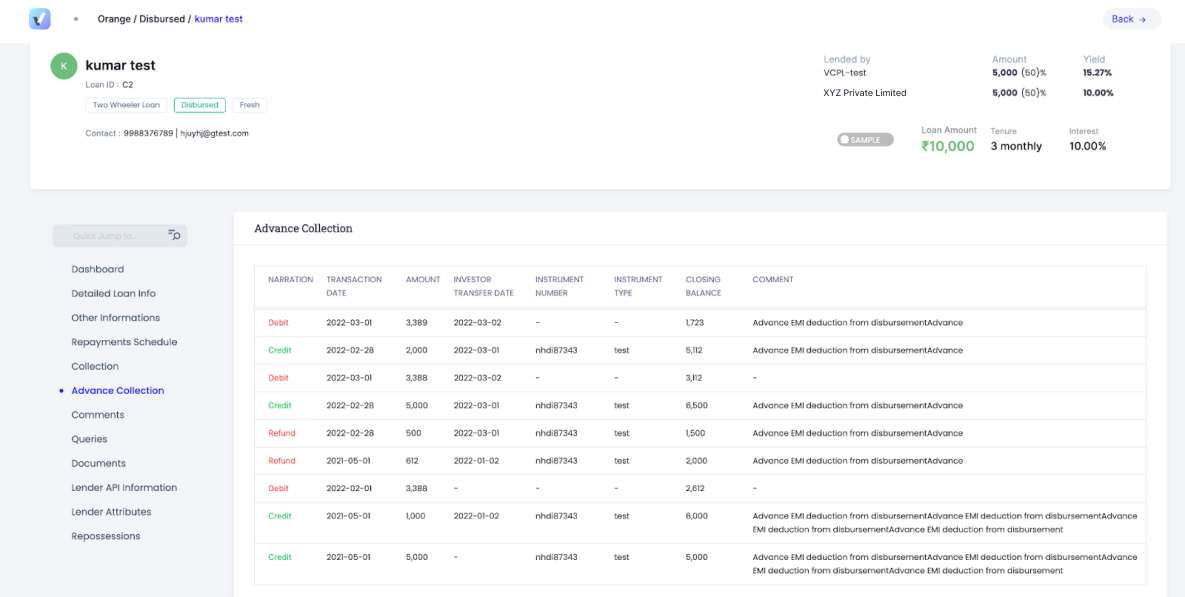

6. Advance payment statement

The Problem

When it comes to tracking and settlement of the funds, investors and originators have sought a statement of advance collections. This feature was not available on the CredAvenue platform until now.

How does the product update solve the problem?

Investors and originators will now be able to view the advance collection statements for each loan.

Additionally, they will also be able to view the debit, credit, and refund transactions along with the corresponding advance outstanding on a particular loan.

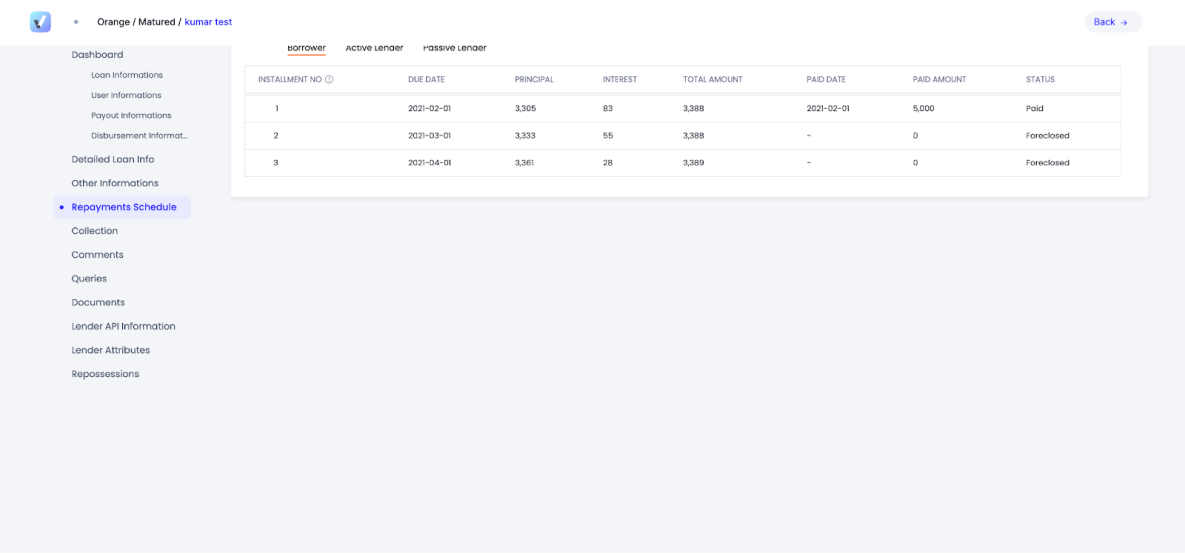

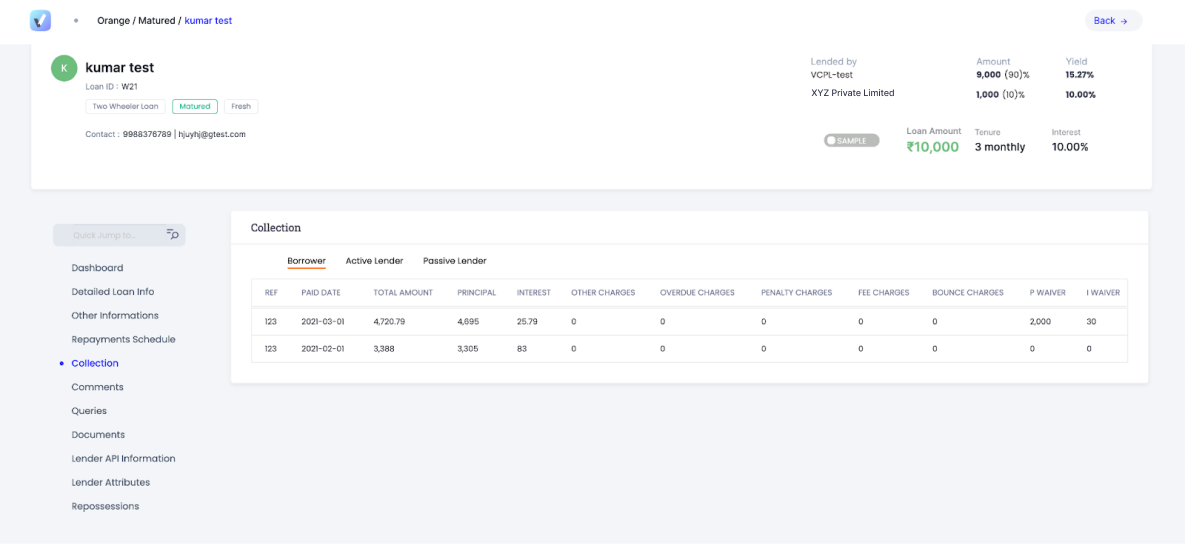

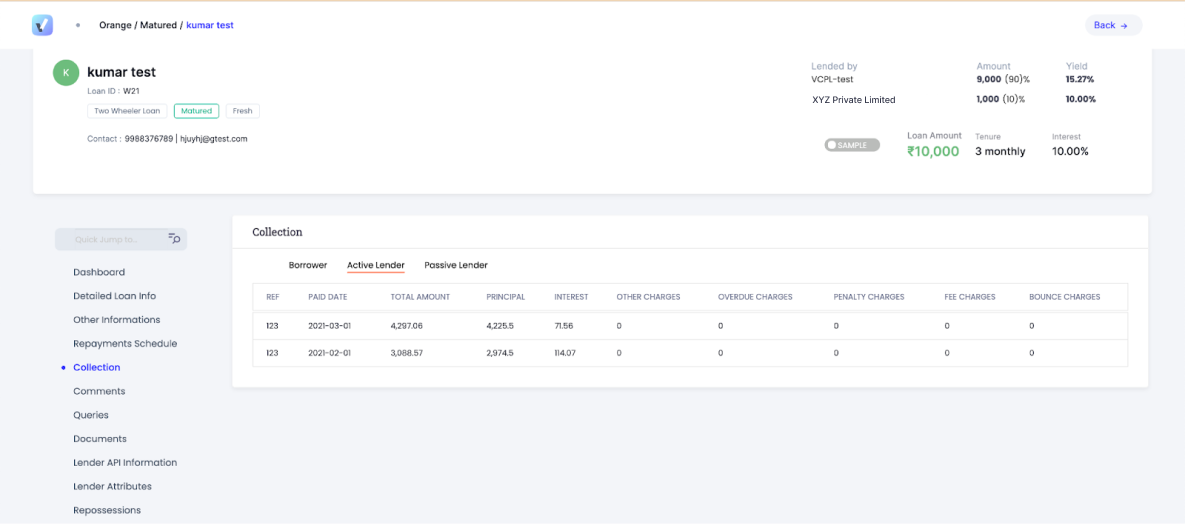

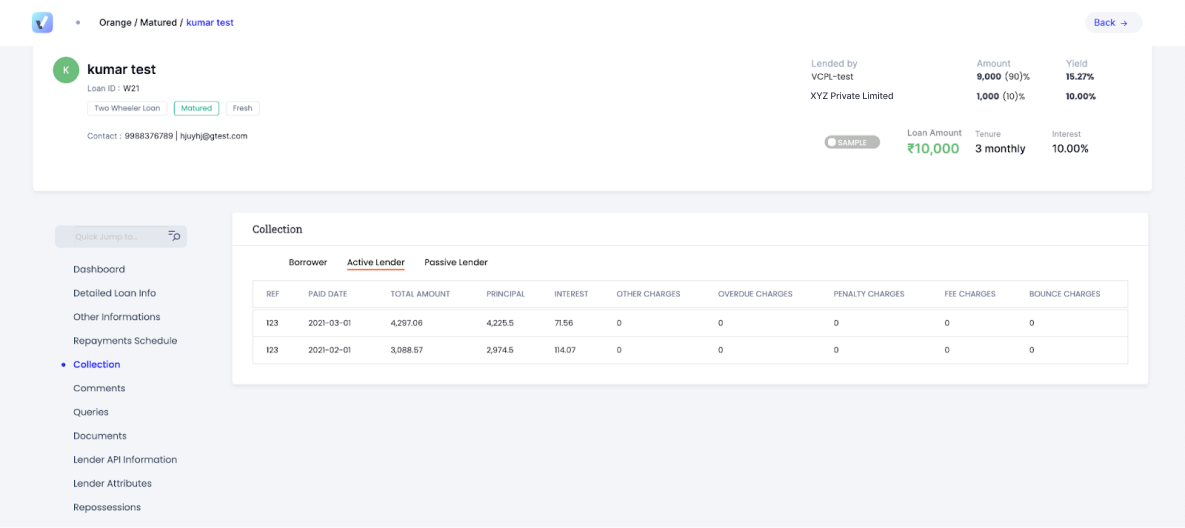

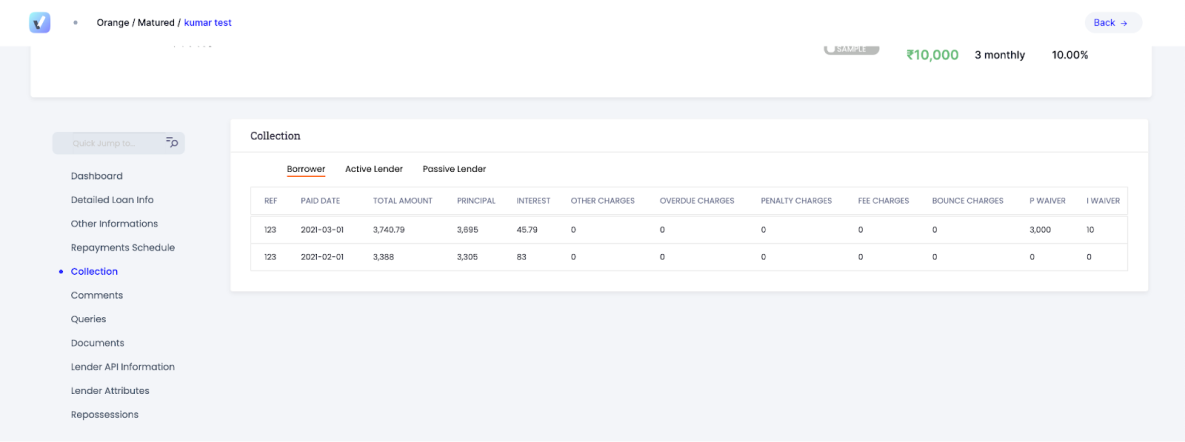

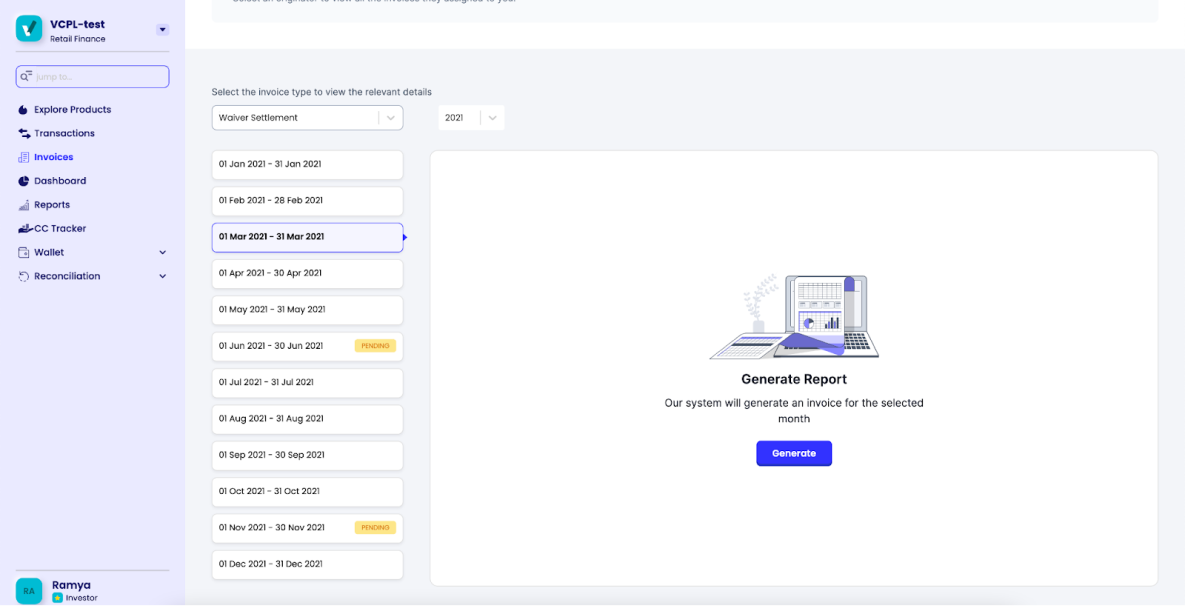

7. Foreclosure waiver

The Problem

There may be instances wherein the originator waives a portion of the loan amount if the borrower makes a foreclosure payment to close the loan early. There was no mechanism to handle a loan with a foreclosure waiver levied on it in such a situation.

How does the product update solve the problem?

The latest update, viz-a-viz the foreclosure waiver, will allow the originators to share with the investors the amount that has been waived via API. After this, the investor may accept the waiver or obtain the due balance from the originator.

If the investor chooses to obtain the balance, CredAvenue will split the collection amount between the investors in the originator taking the same into account.

If the settlement is not complete from the collection amount, the investor can now raise a foreclosure waiver invoice for the due amount.

8. Transaction page revamp

The Problem

Adding more co-lending partners, features, and partners on the CredAvenue marketplace can lead to the transaction pages becoming slow to load. This can hamper the overall customer experience and increase the turnaround time to close a deal.

How does the product update solve the problem?

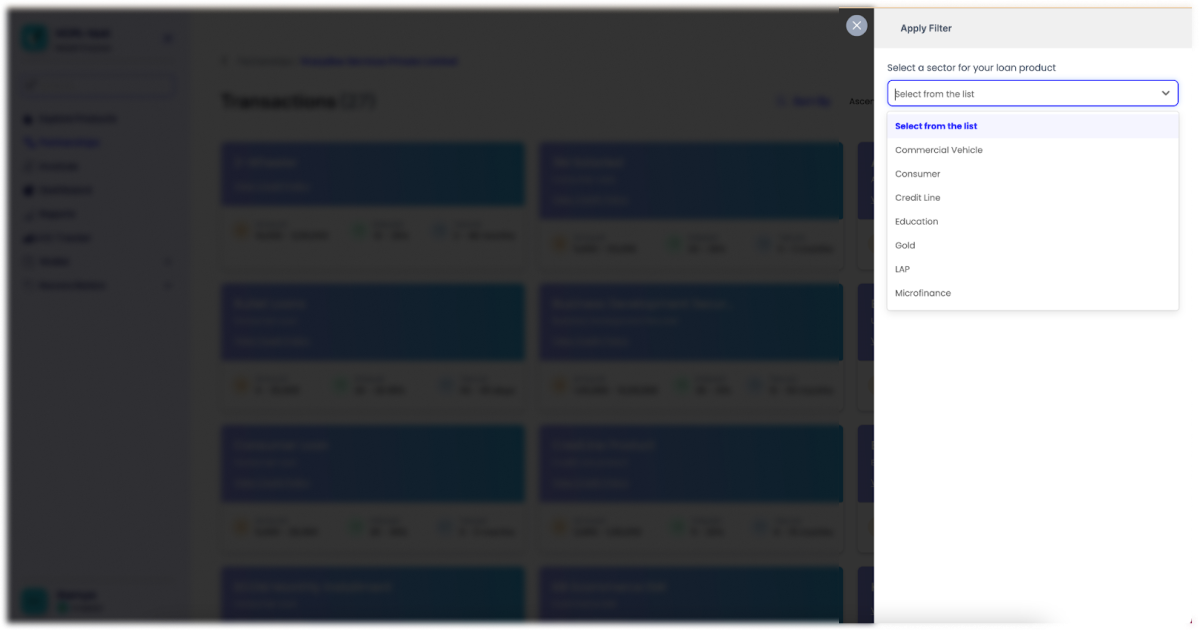

With the latest update, all unused data points can be removed to increase the efficiency of the transaction page.

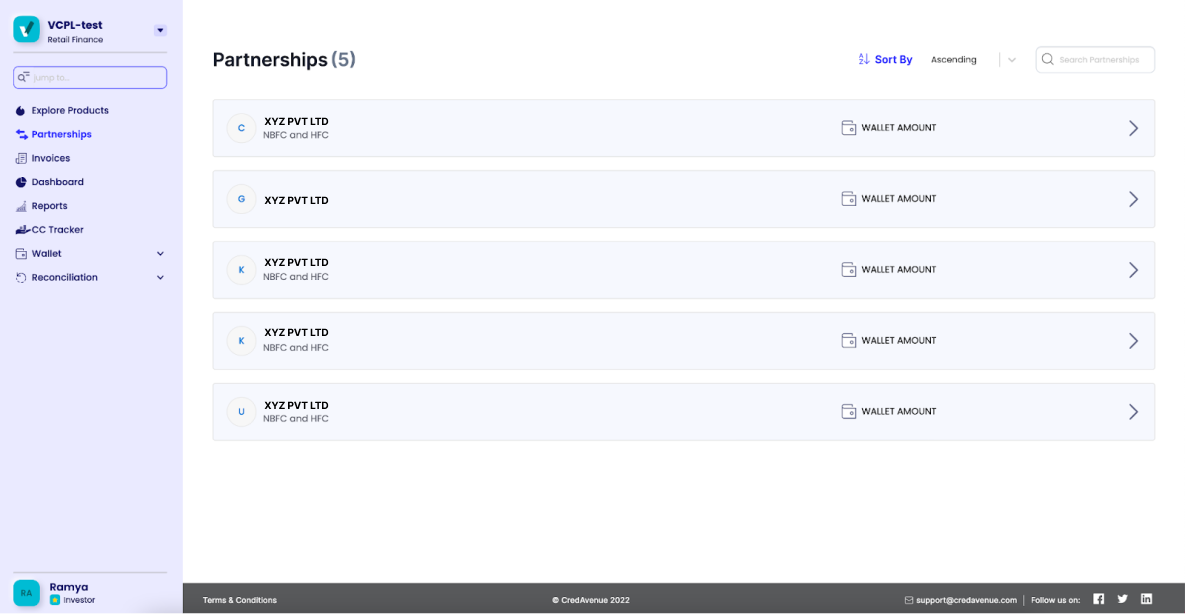

The users will now be able to sort, filter, and search partnerships and transactions, while the performance of the products page has also been improved.

Other updates

- Flexible credit filters can now be used to skip or run the credit criteria for top-up loans based on the co-lending arrangement.

- Bulk upload of files in high volume transactions will be performed via API.

- Users will now be allowed to retry creating a loan with the same loan ID if loan creation failed the last time.

- Loans can be foreclosed by rounding off the balance if the principal outstanding < 1

- Users can now add passwords for individual documents in the document folder instead of having a common password for all documents in the folder.

- Prepayment of loans is now a part of the repayment schedule.

- The root of the problem causing errors in calculating overdue invoices has been fixed.

- The maximum size of loan documents that can be uploaded and exchanged has been increased to 100 MB from 40 MB.

- Users can now make the loan instalment details optional in collection entries.

Hope you start making the most of these features and enjoy using them as much as we enjoyed developing them for you! We have some important and major features releases in the pipeline. Stay tuned for more!