To register for a demo, please write to us at credloan@credavenue.com. Alternatively, you can fill out the Inquiry Form to receive a brochure by email.

Founded in 1985, GPGIL is India’s second-largest float glass manufacturing company, with an annual capacity of 1,250 tons per day (TPD). It carries the distinction of being the first company to get ISI certification for clear float glass manufactured in India. Some of the company’s major projects have been successfully completed, including Infosys offices in Chandigarh and Pune, Days hotel in London, and the Ranbaxy office in Mohali.

The Challenge

- Raise funds to help the company continue in the growth trajectory

- Replace the existing lenders to aid the expansion plans and remove the promoter’s personal security

- Find the most optimal debt product in the minimum possible duration

Gold Plus was ready to implement an innovative debt product in the minimum possible time to achieve business growth without manual intervention.

The Solution

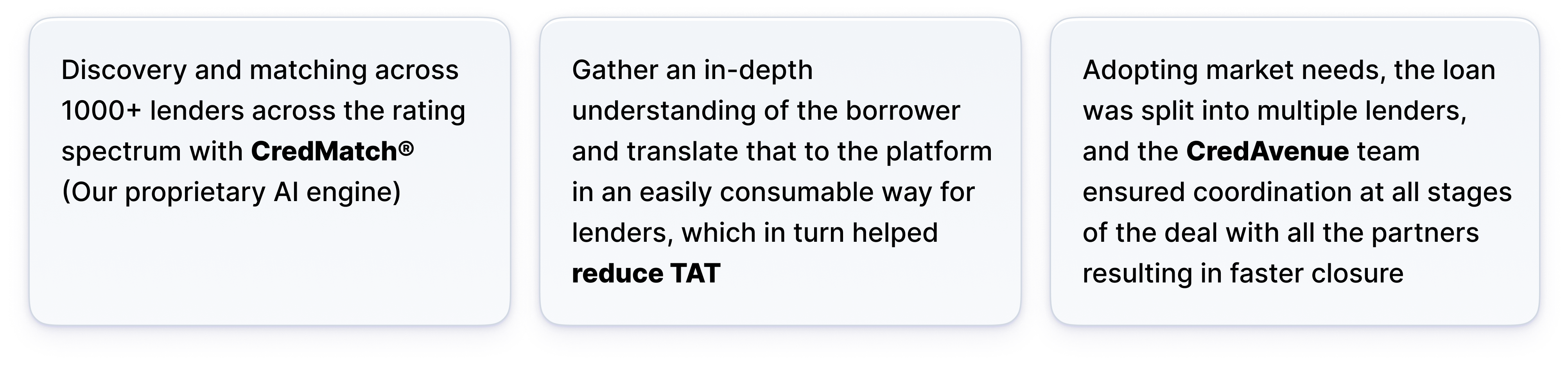

By undertaking a detailed review of the client’s current borrowings problem and carefully plotting a better route forward, CredAvenue’s Loan team designed a system that focuses on three key attributes: Discovery, Execution, and Fulfilment of Loan Requirements.

The Results

Gold plus raised financing in the shortest time possible thanks to the credAvenue loan platform. The partnership between Gold Plus Glass and CredAvenue was quite fruitful, as evidenced by the following statistics.