India’s banking and financial services have seen a surge of innovation driven by entrepreneurship and enabling infrastructure. The Indian Subcontinent takes centre stage with UPI and has become the poster child for massively increasing the penetration of digital payments across the length and breadth of the country. However, despite the progress in digital payment solutions in India, the credit leg of banking remains a huge underserved opportunity, waiting to be tapped.

Technology has lowered distribution costs, improved risk management and customer experience, but due credit must be given to our financial services regulators who have paved the way for transforming the banking sector.

By announcing a change in the Co-lending guidelines in November 2020, the RBI is pushing for collaboration between banks and NBFCs to capitalize on their respective strengths. Increased credit flow kickstarts a virtuous cycle that benefits the entire economy, and access to liquidity can be monumental for small and medium businesses and individual borrowers across the spectrum, who are still reeling from the effects of the pandemic.

What is co-lending?

As the name suggests, co-lending is a collaborative financing model between NBFCs and banks.

Under the revised co-lending norms, there are two models of operation. As per the first co-lending model, banks and NBFCs jointly co-originate, co-underwrite and co-disburse loans to customers in a ratio of 80:20 in real-time. According to the policy, the risks and rewards of fees and interest income are shared between the banks and NBFCs according to the policy. In the second model, the NBFC sources and underwrites loans, and later strikes up a deal with a bank in a sort of claim for reimbursement from the bank in line with the RBI’s credit policy for co-lending. This operating model reduces the credit decision turnaround time for the customer and delivers an improved customer experience.

A co-lending partnership can also be established between 2 NBFCs or even a Small finance bank with an NBFC in the ratio of 100:0. Ratios of 90:10, 85:15, 95:5 have also been seen a few times when two NBFCs are partnering.

However, in either of the models, the RBI does require NBFCs to underwrite and service the loan. Further, the RBI has also defined that the NBFC is responsible for the entire lifecycle management of the customer.

How does co-lending benefit NBFCs and banks?

After the IL&FS collapse, liquidity for NBFCs plummeted sharply, which translated to a high cost of funds for them. Despite their expertise in customer knowledge, product, distribution and underwriting, growth in credit disbursement have been constrained for NBFCs. On the other hand, despite being flush with liquidity, rising competition and slim margins, especially in tier-2 and tier-3 cities, NBFCs are pushing banks to seek new channels and customer segments for growth.

And this is precisely the gap co-lending aims to fill. It gives NBFCs access to low-cost capital and offers banks access to new customer segments historically inaccessible to them – without the high operational costs.

Constrained by their location or absent credit scores, MSMEs, farmers and homeowners in far-flung parts of the country had often been turning to unorganized lenders. By the expansive presence of NBFCs across nooks and crannies of the country, the RBI aims at bringing all such credit-starved individuals and entities under the ambit of an organized lending structure where credit is easy to access.

Recently, many partnerships have been announced, including those between the State Bank of India (SBI) and Adani Capital for co-lending to farmers for tractors and farm instruments and Union Bank of India’s partnership with UGRO to enhance last-mile finance for MSMEs. IndusInd Bank’s co-lending partnership with Samunnati to fund farmer producer organizations (FPOs) across the country claims to have reduced interest rates to 14% per annum for farmer collectives as against a typical 18-20% per annum.

Other beneficiaries of the co-lending model are small businesses, MSMEs, and startups. Startups in India are a cash-hungry ecosystem that seeks easy credit to be able to expand their operations. Between 2015 and 2019 in India, startup investments scaled over 800%, which underlines how the co-lending model is changing the startup funding ecosystem.

The biggest determiner of this is how fintech companies have developed unique ways of underwriting loans. This approach is not yet taken up by the relatively traditional lenders who require profitability, bank statements and other conventional methods to make the decision. However, lenders have gradually started to realise these bottlenecks that startups face in access to credit.

This is where marketplaces like CredAvenue comes into the picture, offering a platform where traditional and bigger lenders provide liquidity to lenders who in turn lend to startups. Startups can now get their hands on flexible underwriting where the lending policies are relaxed and get access to funds easily.

What does the future of co-lending in India look like?

Bank credit growth stood at 5.1% for October 2020 (the lowest since May 2017) and the RBI’s Annual Report points at subdued credit growth across sectors. Banks need partnerships to accelerate credit growth and harness the opportunities across the spectrum of consumers and MSMEs. IDBI Bank’s Deputy Managing Director also expects co-lending to emerge as the future of priority sector lending since banks can tap into NBFCs’ last-mile network and local market knowledge.

Co-lending avoids the pitfalls of an asset-liability mismatch for which many NBFCs were under focus given the IL&FS collapse. Co-lending partnerships can catapult the fortunes of smaller NBFCs who have the reach and operational expertise but not the balance sheet strength to lend aggressively due to tightening norms and a liquidity crunch. Further, the collaboration between two regulated entities, a bank and an NBFC, ensures high compliance and customer protection.

Co-lending has legitimized bank and non-bank lending partnerships and offered a framework for implementing them, which will go a long way in reducing the typical friction in lender-originator partnerships.

However, technology has to be the backbone for the co-lending model to scale and eventually be a major reason co-lending will take off. With the future of lending becoming digitized, the global digital lending industry, which is currently worth $11 billion, is looking at becoming a $60 billion industry by 2025 with digital payments crossing the $1 trillion mark by 2025 with a growth rate of 20% per year. To achieve this target, CredAvenue- India’s biggest co-lending marketplace is bringing together banks and NBFCs on a unified market to allow them to co-lend, which can help propel economic activity.

The RBI’s framework for co-lending requires NBFCs to have the ability to generate a unified statement for any customer via documentation, credit underwriting, and sharing any other information sought by the lender. Despite the promise co-lending holds, many well-rated NBFCs hesitate to enter into co-lending models, given the complexities around integration and processes.

After all, their expertise lies in credit decisions and product distribution and customizing their technology platforms to do business with different banks can be a mammoth, time-consuming task. Banks too, cannot customize systems for one segment and fear data security concerns on opening up their systems to multiple third parties. While the road to streamlining the co-lending process for banks and NBFCs is long, the evolving co-lending technology could make the process hassle-free.

What problem is CredCo-Lend solving?

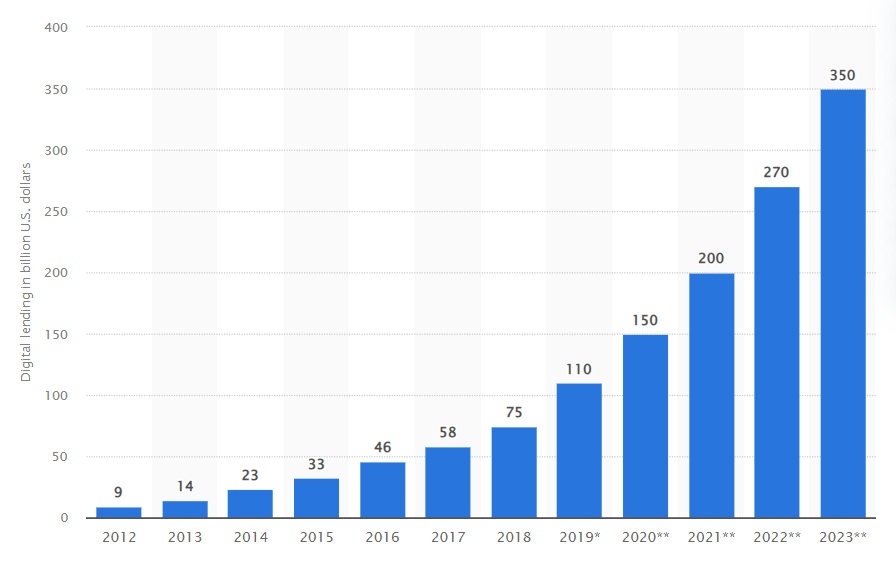

The digital lending sector is poised to grow at nearly 3x to a valuation of US$350 billion in 2023 from its valuation of US$110 billion in 2019 and accounts for 48% of all lending. The co-lending model’s inherent scalability depends on technology. Simplifying instant credit disbursement and real-time back-end operations for co-lending can help traditional banks and non-banks collaboratively capture exciting opportunities in the upcoming years.

CredAvenue’s co-lending platform ensures that compliance with KYC/AML norms is a given apart from other compliances. This translates to setting up ‘tech-first’ co-lending partnerships that can ensure KYC/AML compliance without compromising processing time and seamlessly sharing customer information and supporting documents between the originator and the co-lender.

The partnerships on CredCo-Lend also require the bank and NBFC to maintain configurable loan views with the ability to maintain multiple accounting and reporting policies for different loan products. E-documentation and real-time exchange of data is crucial for co-lending to succeed. In times of ever-evolving customer needs, automated, paperless processing of loans will be a differentiator for loan originators.

Credavenue’s CredCo-Lend simplifies the Information and Data Security (CISO) compliances and the complexity of the process by bringing all lenders and all loan originators to one single platform to manage all their requirements. By developing a marketplace that connects to a pool of lenders and offering a 360° customer lifecycle management tool, CredCo-Lend streamlines the entire co-lending process for both the Lenders and Originators.

Personalized and automated workflows, reconciliation, invoicing and managing repayment split between the co-lenders ensures that the lending institutions can focus on credit disbursal growth and customer expansion without the hassle of long drawn out technical integrations that shifts the focus from their core business.

The demand for credit is on a rise in the years to come. While NBFCs stand to gain the most out of it due to their wider reach, banks too want their share of the pie and are willing to join hands with NBFCs if the borrower quality is good. Thus, this would lead to the success of co-lending as a financial model in the future.