CredAvenue’s supply chain finance arm – CredSCF – is constantly driving meaningful change that makes the business easier for you by the day. Convenience is after all the theme of the year and we at CredSCF understand the importance of ease of information access as well as the necessity to have a bird’s eye view of the processes.

Keeping this in mind, the latest update we bring to you is going to be useful for every beneficiary in the supply chain mechanism – the anchor who raises the deal, the channel partners who support the business, and of course the investors who may be interested in funding the supply chain. Read on below to know more.

Identifying areas of improvement

The process of negotiation between anchors and interested investors can be tedious. There are extensive document exchanges, agreements, and liasoning between sales teams at both ends that happen across diverse communication channels, as part of due diligence. We at CredSCF are aware that this often resulted in exhaustive manual work for the sales teams, and of course, an unwarranted increase in the time taken to close a deal.

And so, we embarked on a mission to optimize CredSCF further to reduce your sales cycle and turn around time even further by possibly eliminating the need to involve sales teams at all! Here’s what we did:

Unified, digitized communication channel for all stakeholders

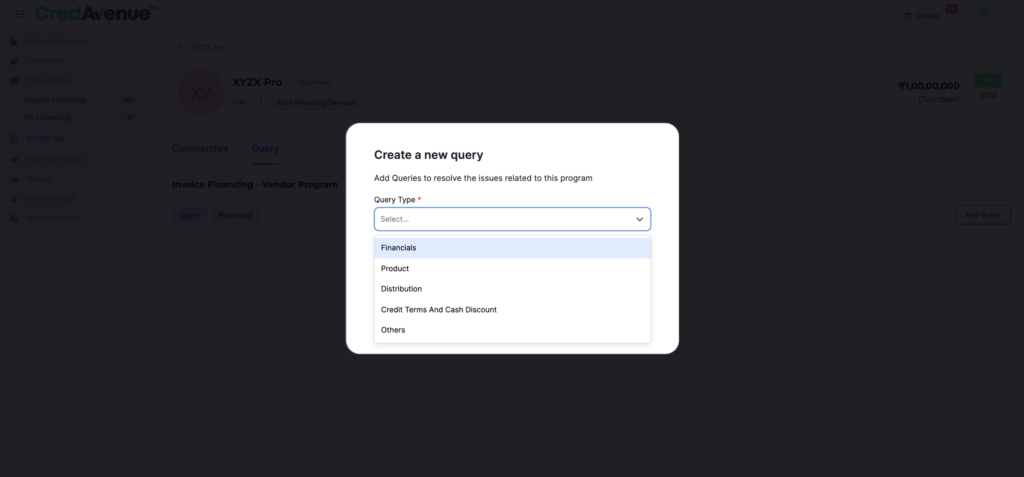

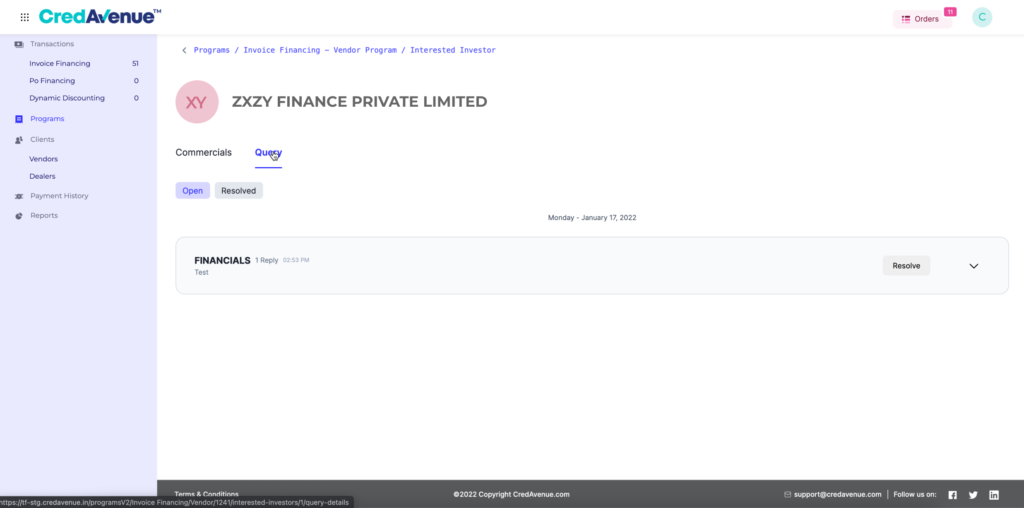

The latest upgrade on the CredSCF platform will allow investors and lenders to raise a query requesting documents and requisite paperwork from the anchor or the channel partner within the system itself. As soon as the investor expresses interest in financing a deal, they can raise a query, nudging the anchors or the channel partners.

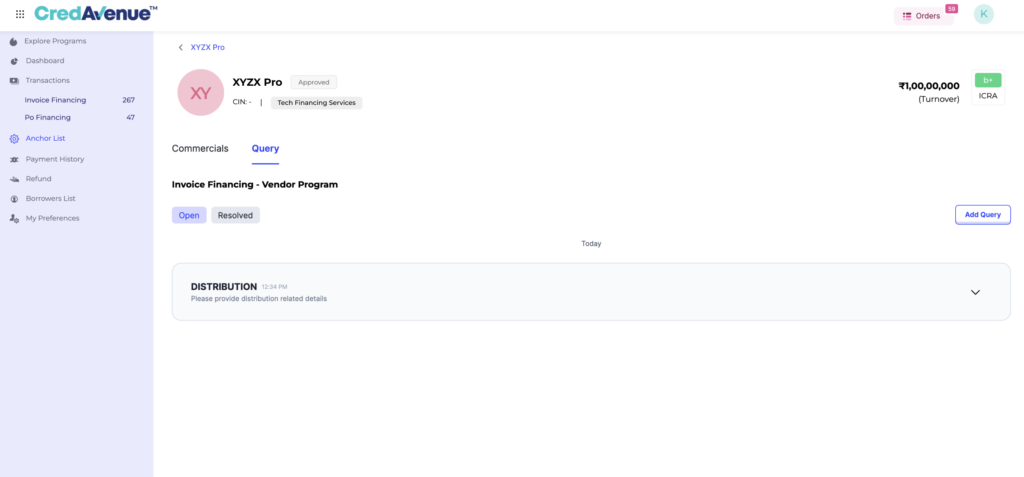

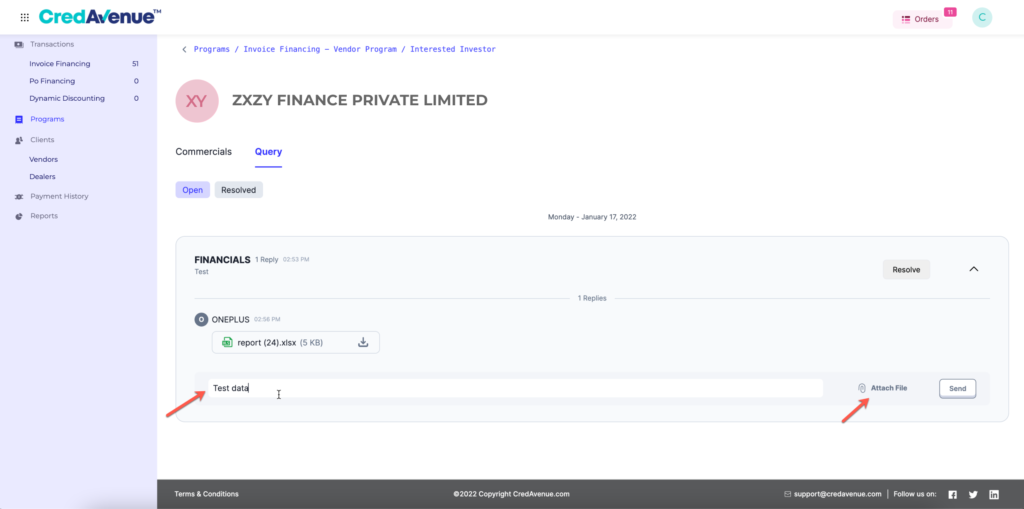

The anchors or channel partners will receive a notification via email whenever there is a query by a potential investor. The anchors and channel partners can respond to this query and expression of interest. Consequently, the anchors and channel partners may upload all the required documents, proofs, and ancillary paperwork in a single conversation thread to maintain records of a formal conversation on the unified platform.

Now, both parties can negotiate the terms and conditions of the deal on a single conversation thread. The conversation records are stored and may be accessed by all parties involved at any time in the future.

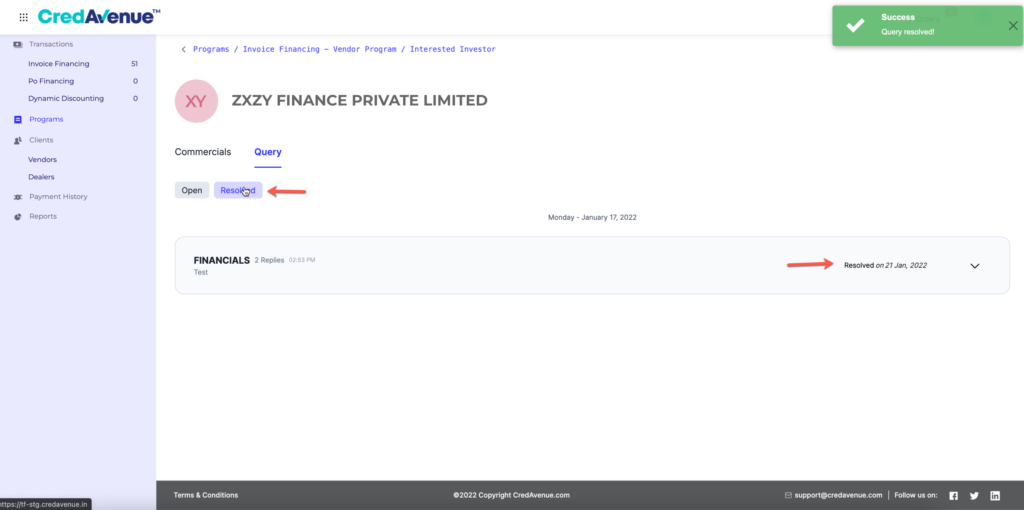

The query can be resolved when the conversation thread is complete after uploading the required documents.

With this update, we automate the conversations around documentation and your sales teams can be diverted to more pressing matters that will optimize business at your end. CredSCF’s latest product upgrade also goes the next mile – it acts as an asynchronous communicator between anchors, channel partners, and investors, invoking clear, crisp, and transparent communication.

Finding the right partner to finance supply chains just got easier on CredSCF!