Supercharged by robust API workflow enhancements, CredAvenue has upgraded its dashboarding features to provide enhanced analytics and monitoring facility for your loan disbursement process.

Let’s take a quick peek into the specific updates:

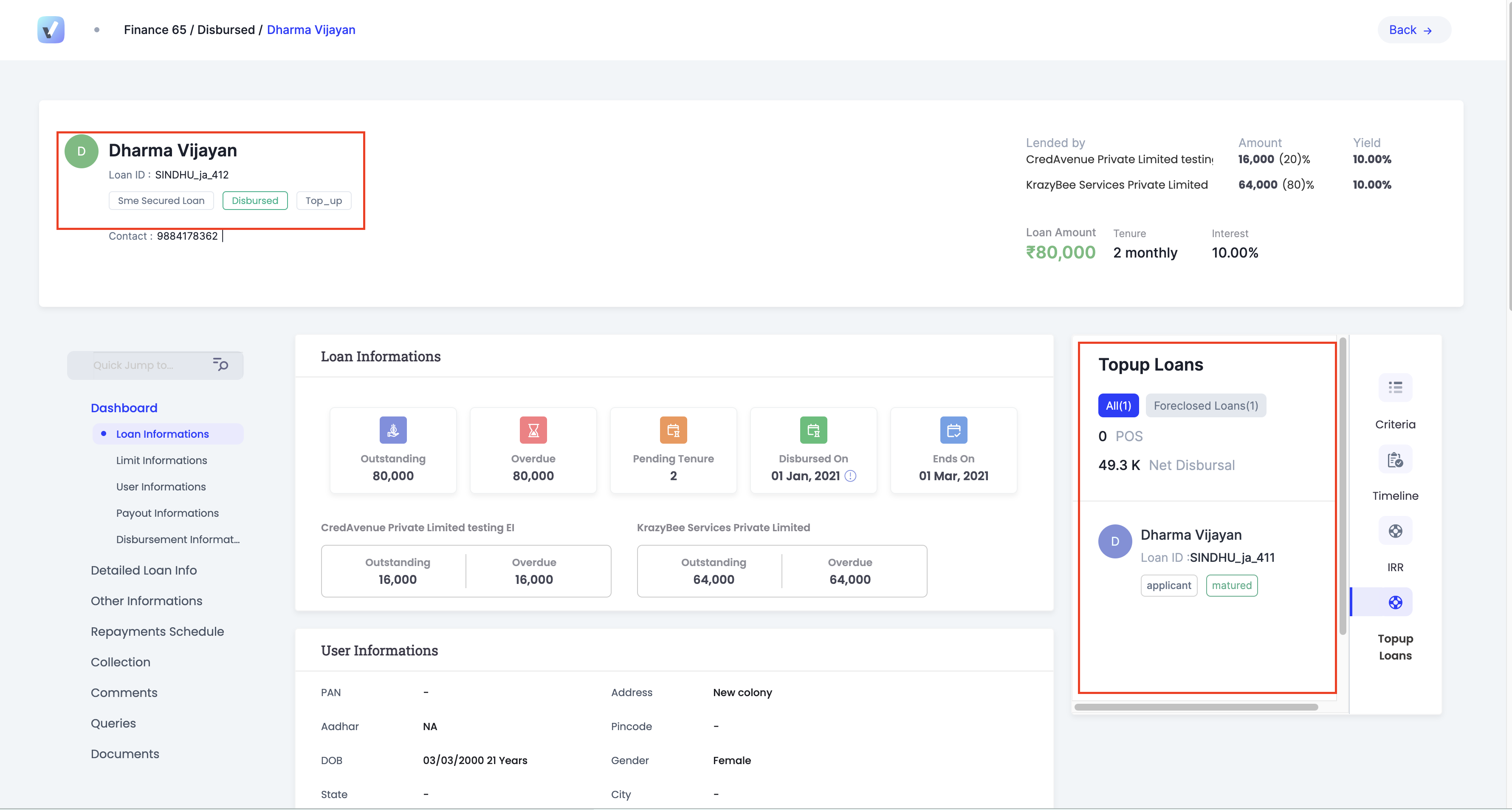

Top-up loans:

CredAvenue’s top-up loan feature allows Originators to create top-up loans for a borrower as a new loan linked to the old one with the help of the linked Loan ID. Users can find the linked Loan ID for a borrower in the ‘Top-up loans’ section of the ‘Loan Dashboard.’ In addition to the Loan ID, the investor can also find the net disbursed amount and the POS details in the ‘Top-up loans’ section. The feature also allows the investor and originator to track the exposure against a borrower.

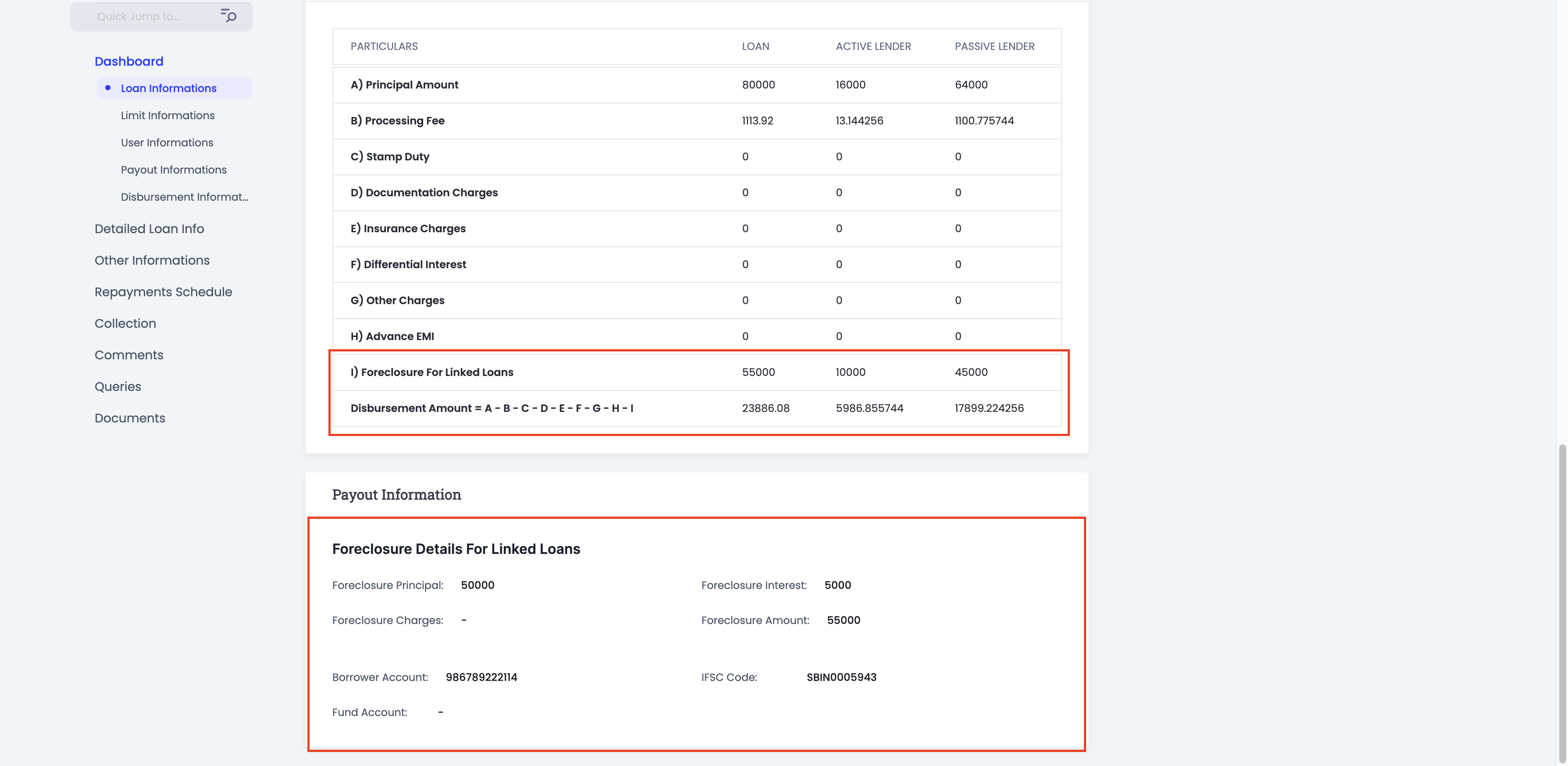

Originators can also proceed with foreclosing loans through the system. For this, the Originator will need the linked Loan ID, foreclosure amount, interest amount, and other charges. All these details can be found in the ‘Payout Information’ section on the Loan Dashboard. The foreclosed loan amount will be displayed in the Disbursement Information panel, and the same will be considered for net disbursement.

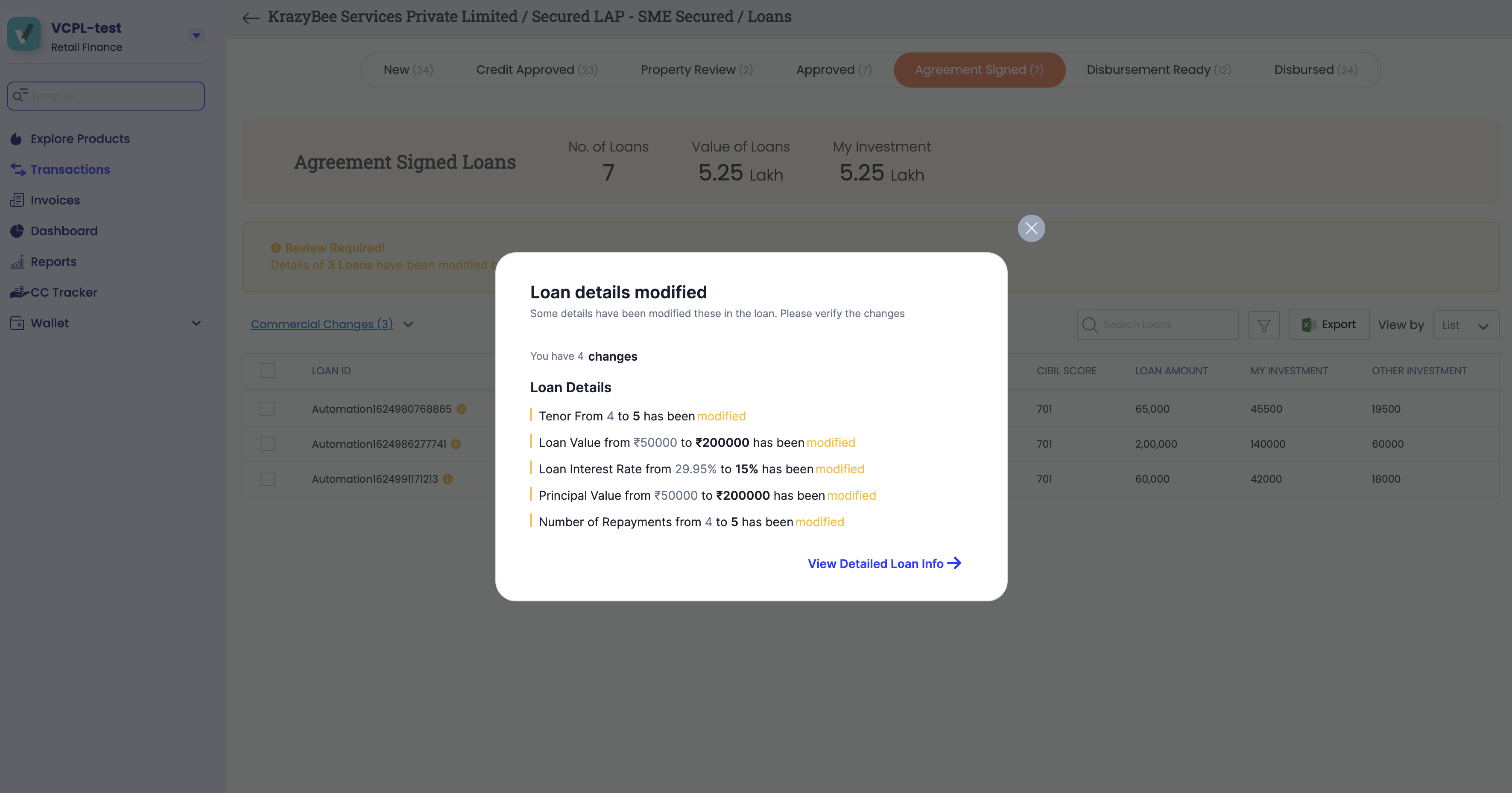

Update loan commercials:

Depending upon the requirements, the Originators are now able to update details of the loans at any stage of the loan process, be it interest rate change, tenure of the loan, or the repayment schedule. Any such modifications in the loan will be notified to the investors on their dashboard as a highlighted icon. All the details of the change can be accessed by the investors by clicking on the highlighted icon.

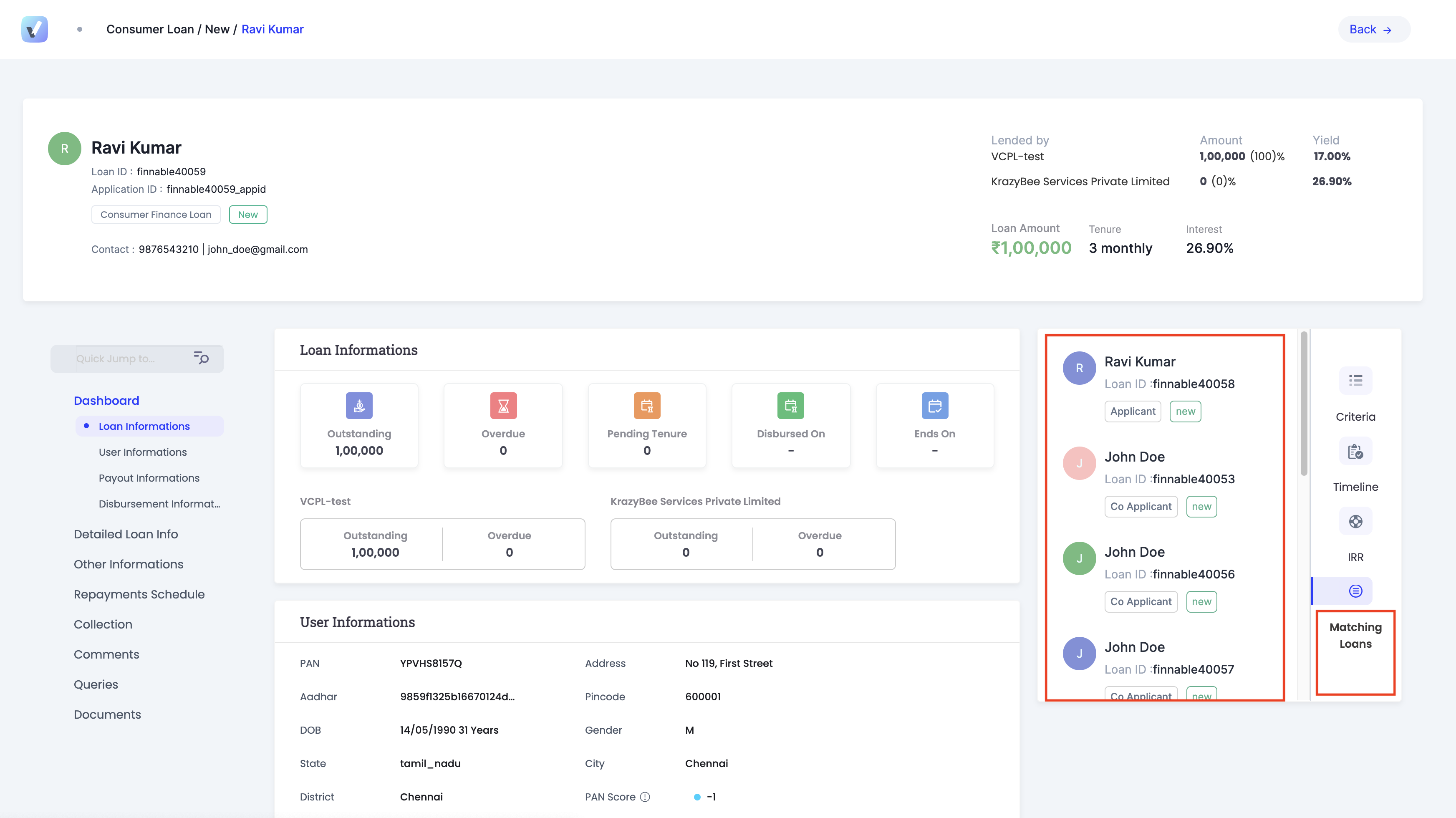

De-dupe (Algo enhancement for Borrower):

A profile ID is assigned to a borrower after the CredAvenue system checks the dedupe functionality. For this, IDs like Aadhaar Card, PAN Card, and Voter ID can be used.

CredAvenue will then use the Borrower’s profile to show loans that match the Borrower and the investor. If there are Guarantors or co-applicants linked to the loans, they will also be displayed for the matching loans.

CredAvenue is a one-stop-shop for all things debt that helps connect banks, NBFCs, small companies, and individual investors. CredAvenue offers an all-in-one solution to debt financing with a huge market of lenders and asset monitoring features to help manage your portfolio.

Click here to sign up as an investor and tap into the pool of 1000+ borrowers!

About Cred Co-Lend

Cred Co-Lend is revolutionizing the co-lending ecosystem in India by connecting banks and other financial firms on one platform in a seamless manner. As a one-of-a-kind co-lending platform, CredAveue helps you leverage the debt market using state-of-the-art technology.

Automate invoicing, FLDG settlements and collection via CredAvenue’s developer-friendly API-driven platform and tap into a pool of 250+ investors to find the right co-lending partner for you! Now find co-lenders that suit your needs and enjoy seamless loan processing.